Dear Sir,

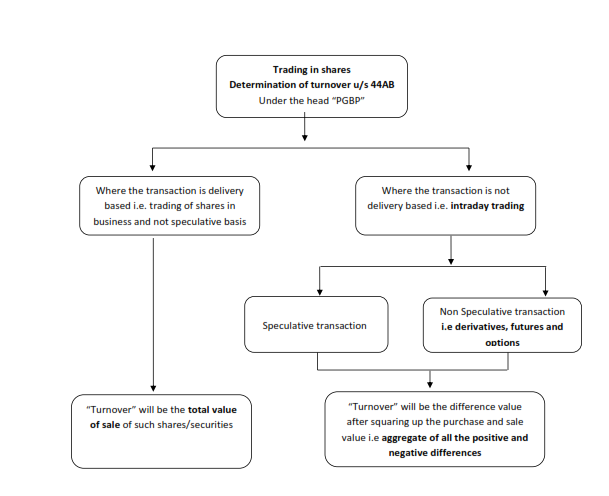

I am salaried individual and invest in intraday Equity shares please let me know am I liable for tax audit and how to calculate the turnover in intraday ?

I have visited many CA and every one had given me different opinion they are as follow

1) Total of Purchase and Sales is considered as turnover for Tax Audit .

2)Total of sales made is considered as turnover and in my case tax audit is not needed as I am not doing it as a business.

3) Total of differences in intraday transaction is treated as turnover and I need to maintain accounts and they are charging heavily for the same.

I am very confused and need your assistance on this and guide me choosing the right option for filing the income tax.

CAclubindia

CAclubindia