Dear All,

I have purchased a new property 4 months ago and deducted 1% tax and deposited it using online Tax payment at time of purchase.

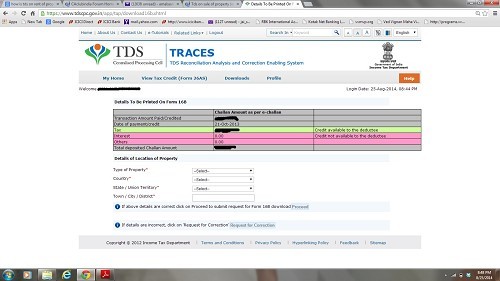

My bank account stands deducted for the TDS amount, and my Form 26AS shows the property purchase transaction. However, the column "TDS Deposited" in form 26AS (both in my and seller's form 26AS) shows "zero" amount. As a result the seller is not able to get credit for the amount deducted.

My analysis so far has revealed the following -

- I had made house purchase payments in 5 installments and hence paid online TDS by 5 separate transactions.

- After filling online Form 26QB, there is an instruction that states "that on getting redirected to the Bank's website, I should be selecting "Income Tax" or "Basic" Tax option for the payment to correcty reflect in Form 26AS.

- However, I realized this instruction only after I paid the first 3 transaction using "Other Taxes" option on the Bank's website. I correctly paid the last 2 transactions using the "Income Tax" option on the Bank's website.

- For the first 3 transactions, the "TDS Deposited" amount is shown as "Zero", while the last 2 transactions are being correctly reflected in Form 26AS.

- All major and minor heads and PAN numbers are correctly filled up. The only mistake made was that while on Bank's website, for 3 transactions, I selected the "Other Taxes" option instead of "Income Tax".

- I approached my Bank for correction, and they could not understand nor appreciate the problem.

- I met my Assessing Officer, and he seemed to care little or nothing about my problem. After being directed from one desk to another in the income tax office, I came to a dead end. No one seemed to understand the problem or care to spend a minute to explain the procedure to resolve this issue.

- Please advise on the following -

- If there is any known solution to this kind of an issue.

- If none, what is the escalation matrix to resolve this issue.

- Any other means to resovle the issue.

I am in a situation where my bank account is deducted, seller is putting pressure for getting credit and the Income Tax authorities are not responding and not bothered. Any and all help would be of greate help.

Regards

CAclubindia

CAclubindia