Menu

Tds late payment

Dear Seniors,

My doubts is...

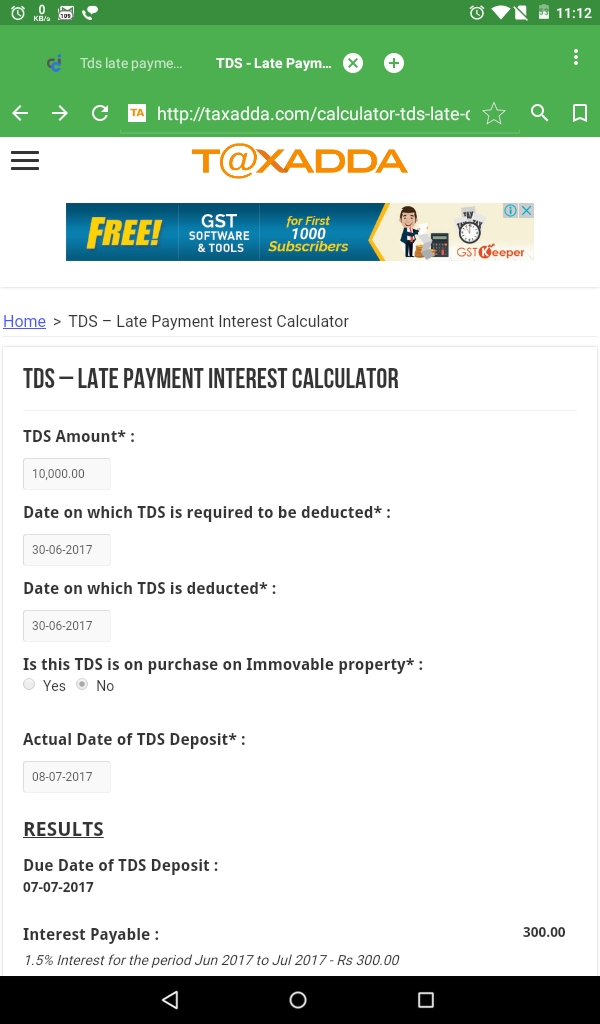

1) Is we have to pay the interest on TDS if its one day delay payment (next day morning of due date)?

2) I tried for the TDS payment through SBI online by 7.7.17 evening, which transaction was unsuccessful...? what is the solution for this.

Replies (9)

Recent Threads

- TDS DEDUCTED BUT NOT PAID BY EMPLOYER

- GST RCM GTA

- TDS Challan interst amount wrongly paid as surchar

- Query on TDS & Stamp Duty

- Query on form 26QB and TDS deduction

- Received this confusing IT notice. How to reply

- Houston Sign Company For Custom Signs, Banners &am

- Refund due to change in GST Rate Tobacco Products

- Lease related query can we rent out lease ?

- Planning of Ceased a Business i.e Closure of Compa

Related Threads

CAclubindia

CAclubindia