Chartered Accountant

3162 Points

Joined February 2012

Section 288 of the Income Tax Act, 1966:

(1) Any assessee who is entitled or required to attend before any income-tax authority or the Appellate Tribunal in connection with any proceeding under this Act otherwise than when required under section 131 to attend personally for examination on oath or affirmation, may, subject to the other provisions of this section, attend by an authorised representative.

3(2) For the purposes of this section, “authorised representative” means a person authorised by the assessee in writing to appear on his behalf, being—

(i) a person related to the assessee in any manner, or a person regularly employed by the assessee; or

(ii) any officer of a Scheduled Bank with which the assessee maintains a current account or has other regular dealings; or

(iii) any legal practitioner who is entitled to practise in any civil court in India; or

(iv) an accountant; or

(v) any person who has passed any accountancy examination recognised in this behalf by the Board4; or

(vi) any person who has acquired such educational qualifications as the Board may prescribe5 for this purpose; or

6[(via) any person who, before the coming into force of this Act in the Union territory of Dadra and Nagar Haveli, Goa†, Daman and Diu, or Pondicherry, attended before an income-tax authority in the said territory on behalf of any assessee otherwise than in the capacity of an employee or relative of that assessee; or]

(vii) any other person who, immediately before the commencement of this Act, was an income-tax practitioner within the meaning of clause (iv) of sub-section (2) of section 61 of the Indian Income-tax Act, 1922 (11 of 1922), and was actually practising as such.

Explanation.—In this section, “accountant” means a 7chartered accountant within the meaning of the Chartered Accountants Act, 1949 (38 of 1949), and includes, in relation to any State, any person who by virtue of the provisions of sub-section (2) of section 2268 of the Companies Act, 1956 (1 of 1956), is entitled to be appointed to act as an auditor of companies registered in that State.

Summary of the above provisions: A chartered Accountant is authorised to act as a representative of the assessee before any Income Tax Authority or Appellate Tribunal (but not before any court or in the case of proceeding u/s 131)

And no court can give any judgement which is ultra vires the Act.

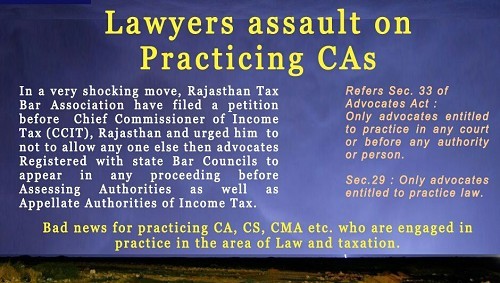

So Mr. Ganesh, I'm unable to figure out how can it have any effect to the practicing chartered accountants.

CAclubindia

CAclubindia