Dear CAs and Tax Gurus

While filing my ITR for FY 19-20, I saw that RBL bank has reported SFT. I read about SFT on internet and understood to some extent but not sure if I understand it well enough.

I do have FDs in RBL bank of more than 10 Lakh but new FDs of that much amount were not opened in during FY 19-20. Also the entry from the bank says amount 0.00

I am paying all TDS + additional tax on the FD interest income properly.

Just wanted to understand:

1) What is the entry about and qualifies under which criteria?

2) Do I need to file some other form or furnish some additional details on account of this SFT reported by bank?

Can you please help me understand this and take necessary action if anything is required to be done from my side apart from filing my income tax return normally like every year?

There are the details:

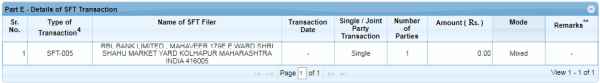

Part E - Details of SFT Transaction

|

Sr. No. |

Type of |

Name of SFT Filer |

Transaction Date |

Single / Joint Party |

Number of |

Amount ( Rs. ) |

Mode |

Remarks** |

|---|

| 1 | SFT-005 | RBL BANK LIMITED , MAHAVEER 179E E WARD SHRI SHAHU MARKET YARD KOLHAPUR MAHARASHTRA INDIA 416005 | - | Single | 1 | 0.00 | Mixed | - |

|

View 1 - 1 of 1 |

Also, from an awareness perspective for future I would like to know this:

- My annual income is approx 14-15 lakh mostly from salary + interest on FDs

- I have decent amount of savings in multiple bank accounts and based on best interest offered from time to time, I shuffle my FDs from one bank to another accordingly. So, it might happen that deposits in a particular account is more than my annual income in particular year. Is that something I should be concerned about?

- Specifically, I have approx 25 lakh saving in IDFC first bank savings account as it is offering 7% interest rate. Would this be reported as SFT next year and if so what form I need to fill up and what details I need to furnish.

As a common user / tax payer, I feel this government is complicating Income tax system rather than simplifying it! :(

CAclubindia

CAclubindia