We are Govt. Civil-Engg. Works Contractor, (this is the first time we enrolled ourselves with GST/VAT etc.. we were unregistered-before for past many years)

Partners of our partnership-firm have various daily expences like train-tickets, toll-receipts etc.. (which are used for day-to-day business-work) ,

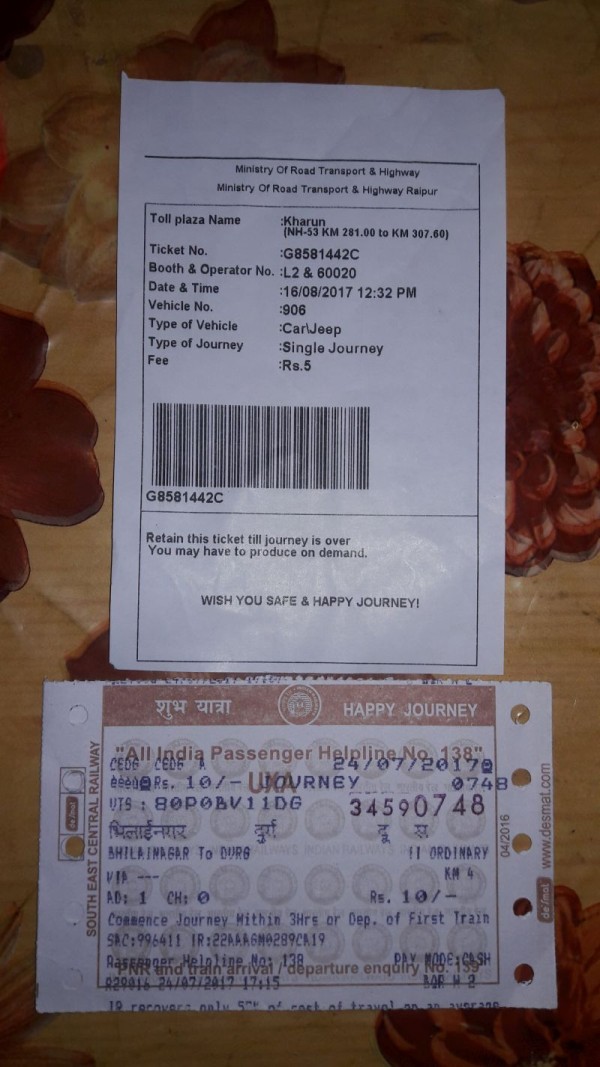

[KINDLY CHECK THE IMAGE - https://goo.gl/QxYkaW]

Now; the toll receipt doesn't mention any GSTIN number BUT; the train-ticket does have it's GSTIN Details.

[in the image the amount of 5 or 10 rupees might look minor, but not all receipts are of petty-amounts & with-in a financial-year these amount upto thousands of rupees]

I want to know how am i supposed to go ahead with these kind of expences in GSTR-2 & GSTR-3B ??

[is there any cloumn in gstr2/gstr3b for these things/expences without or without ITC]

OR;

is it that, it's not necessary to mention these in GSTR-2/GSTR-3B ??

CAclubindia

CAclubindia