How to Generate E-Way Bill

An eway Bill is an ‘electronic way’ bill for movement of goods which can be generated on the eWay Bill Portal. Transport of goods of more than Rs. 50,000 (Single Invoice/bill/delivery challan) in value in a vehicle cannot be made by a registered person without an eWay bill from 1st April 2018. E-way bill can be generated or cancelled through the e-way bill website, LEDGERS GST Software, SMS, Android App and by Site-to-Site Integration (through API). When an eWay bill is generated a unique eWay bill number (EBN) is allocated and is available to the supplier, recipient, and the transporter. In this article, we look at the steps to generate a e-way bill on the Government website.

Know more about e-way bill.

Steps to Generate E-Way Bill

E-way bill can be generated on the GST eWay Portal. To use the portal, you will need a GST registration and transporter registration.

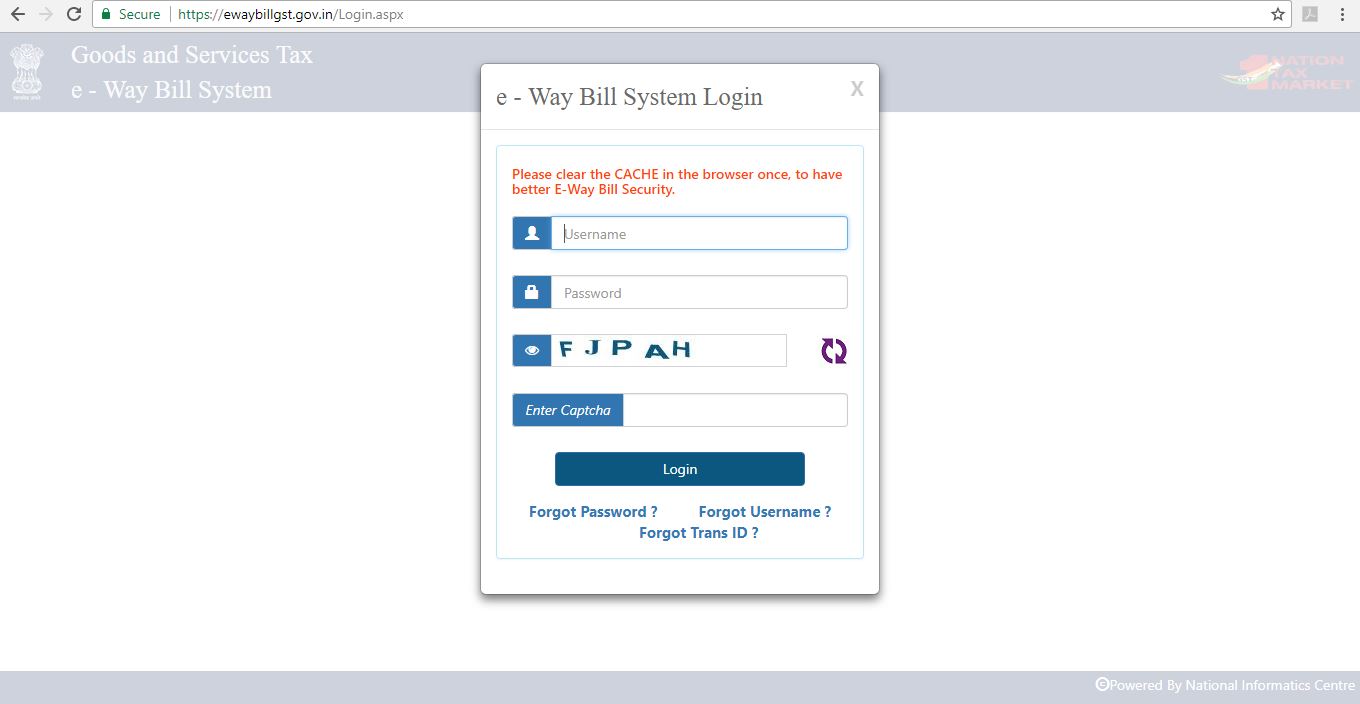

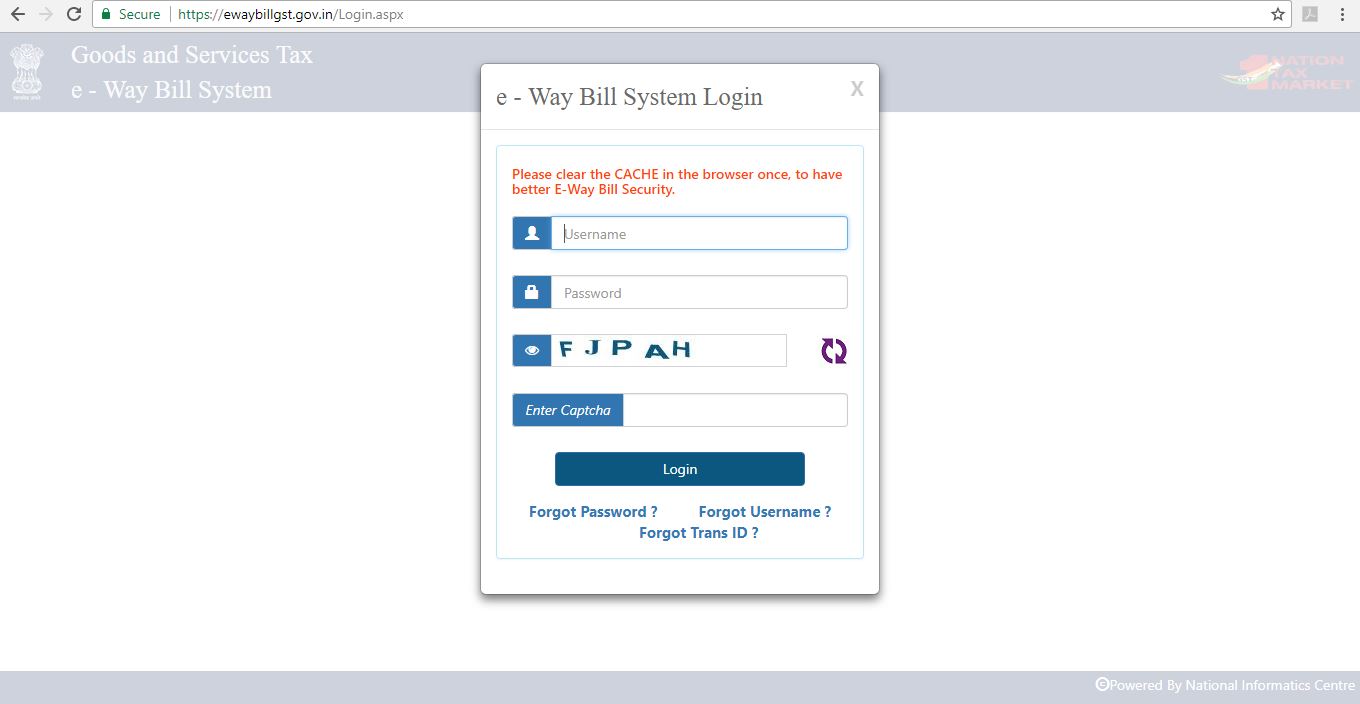

Login to E-Way Bill Portal

Step 1: Access the eway bill generation portal at https://ewaybill.nic.in/ and enter the login detail to enter the platform.

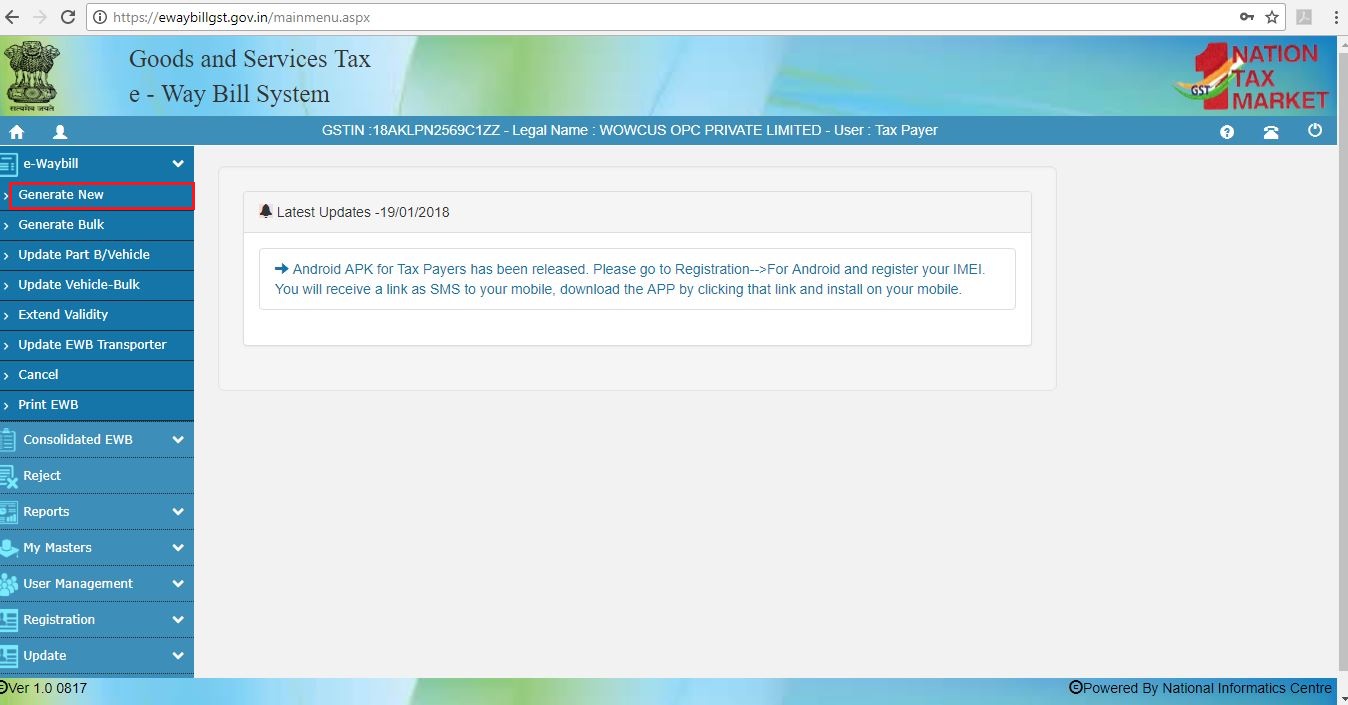

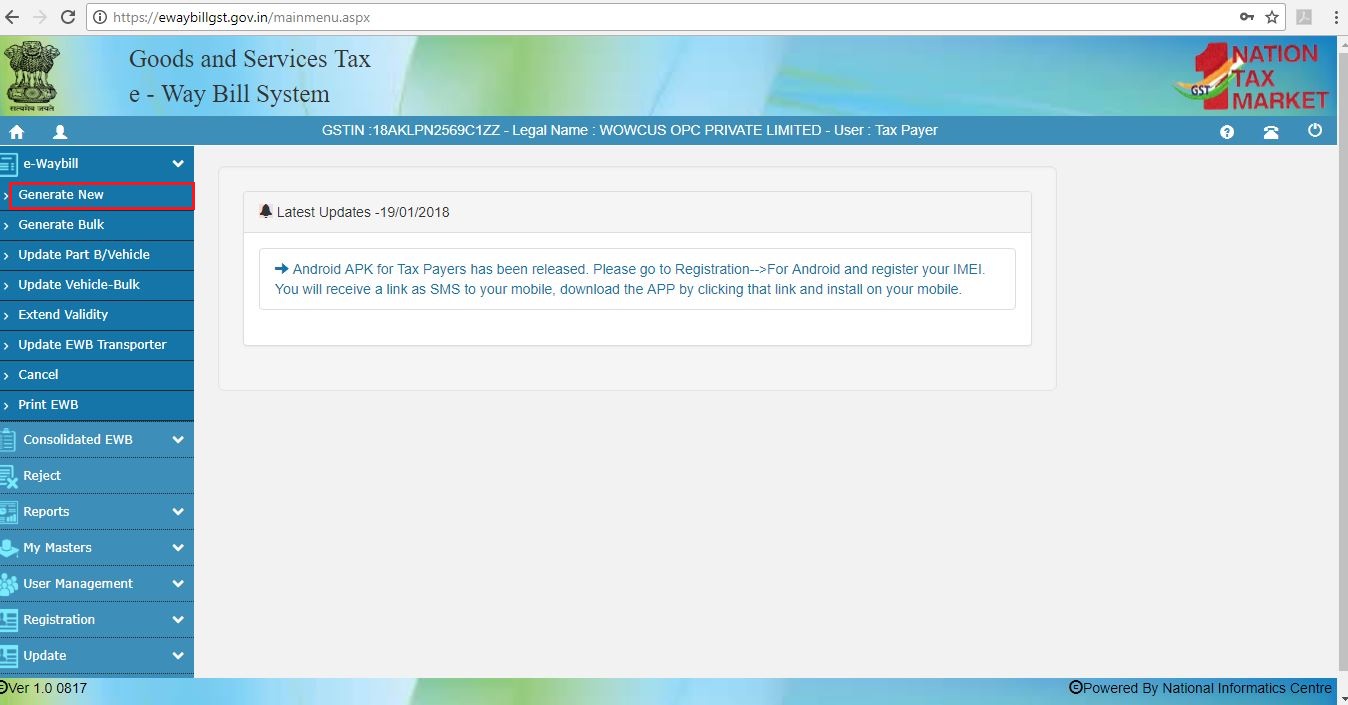

Step 2: Click on the “Generate New” option from the eWay bill- Main menu page to generate a new eWay bill.

Generate eWay Bill

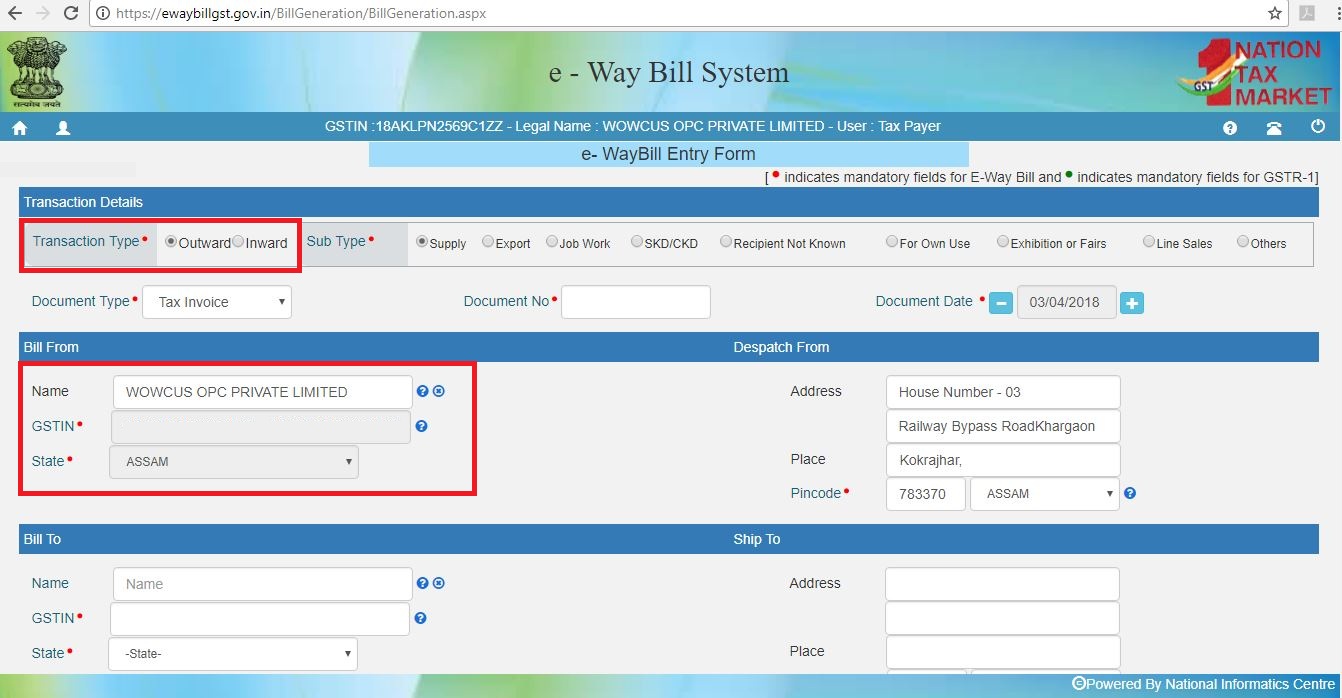

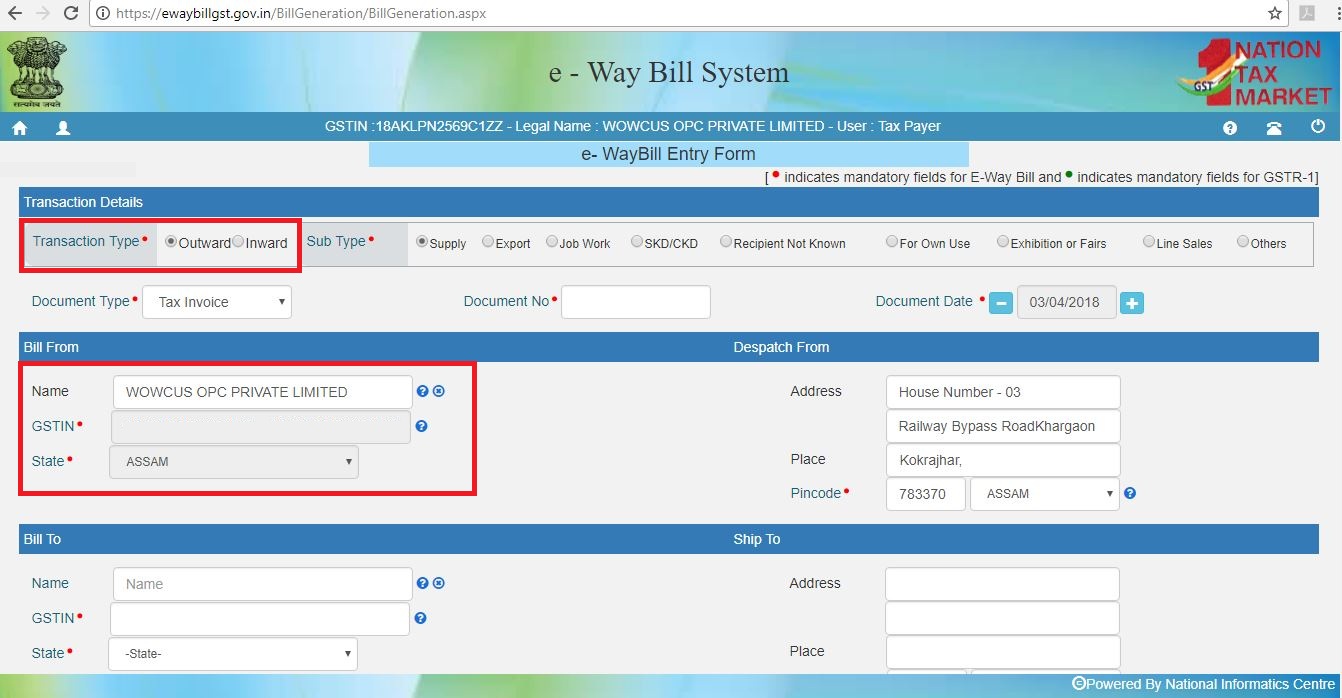

Step 3: A new eway bill generation form appears. Fill in the details required similar to creating a GST invoice.

Select outward, if you are the supplier and inward, if you are the recipient. Enter details of the supplier and recipient along with GSTIN, wherever applicable.

When a registered GSTIN is entered in the field provided in the form, other details gets pulled into the empty fields. Before proceeding to the next step kindly check the details.

Enter Goods Descripttion

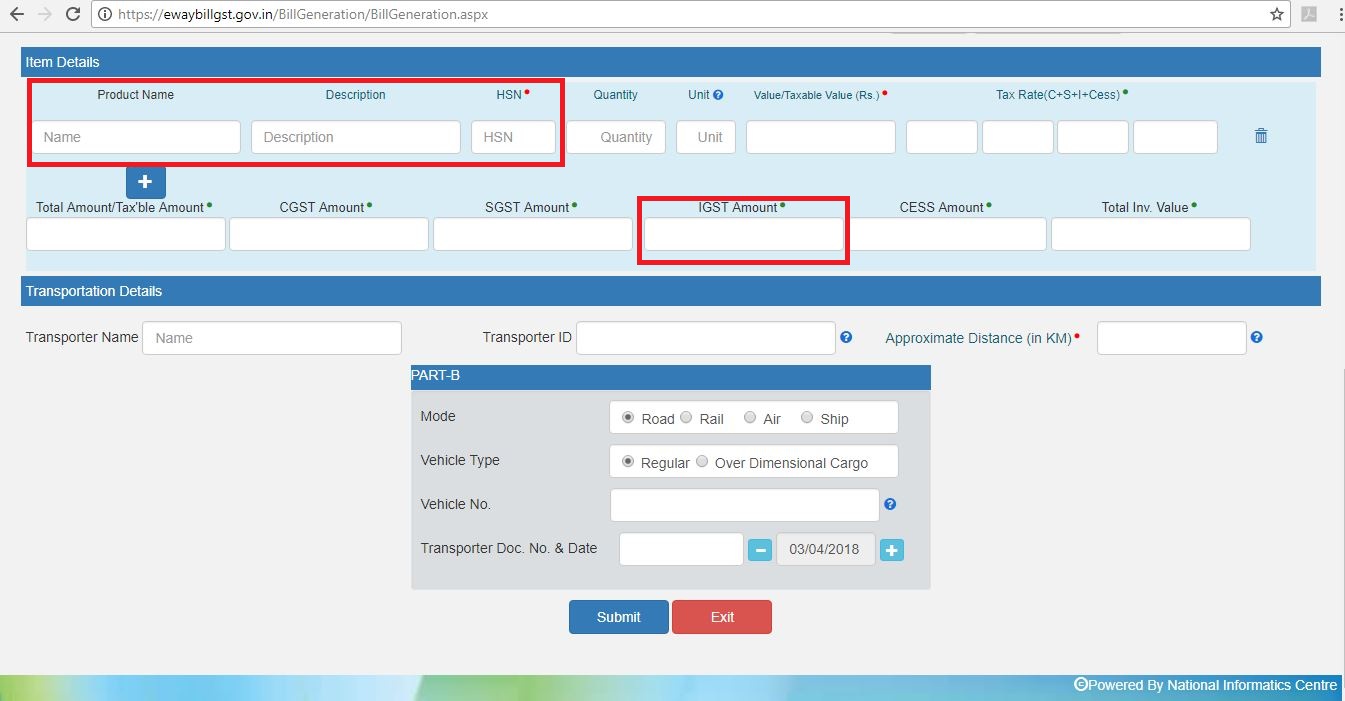

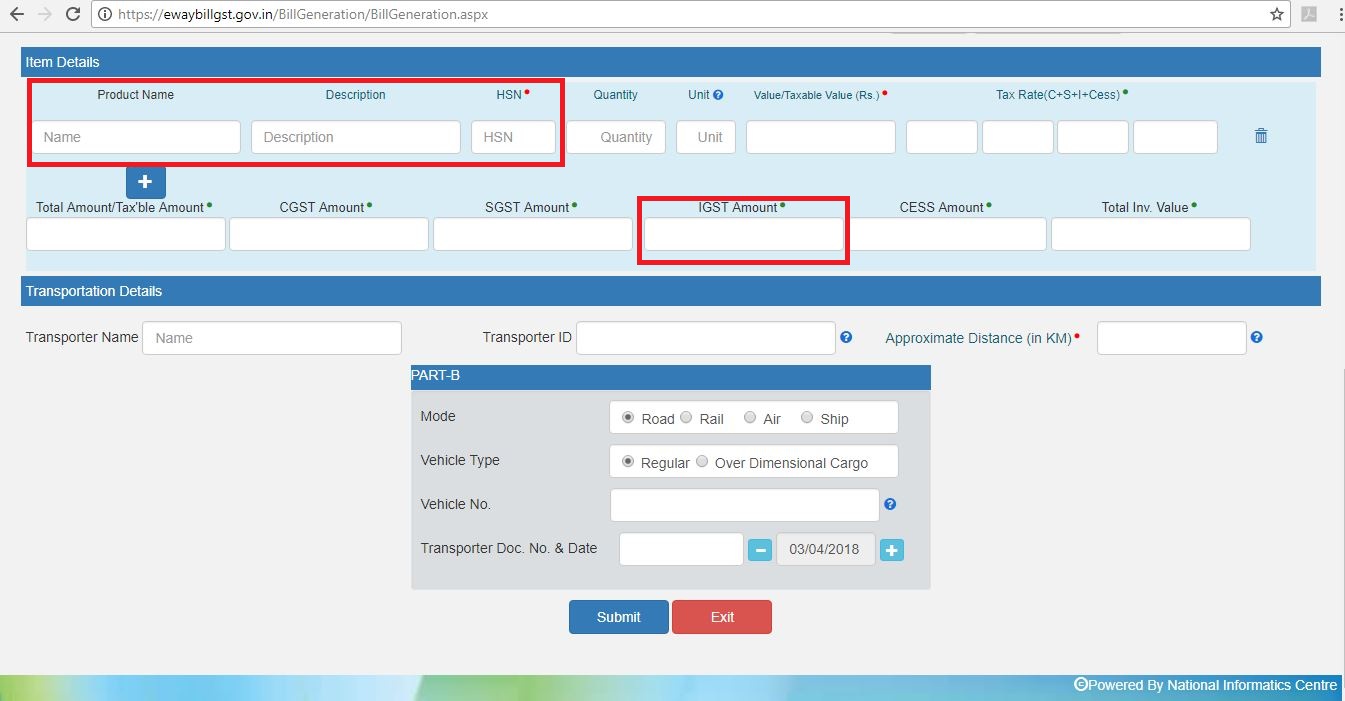

STEP 4: The second half of the page will contain information to be filled as follows:

- Product Name and Descripttion must be completed similar to a tax invoice.

- HSN Code for the Product must be entered. Click here to find HSN code.

- IGST or CGST Rates applicable. IGST would be applicable for inter-state transport and SGST / CGST for intra-state transport.

- Approximate distance of transport. This would determine the validity of the eway bill.

Step 5: Generate E-way bill

Click on the “SUBMIT” button to generate the eWay Bill. The eWay bill gets displayed which contains the eWay Bill number and the QR Code that contains all the details in the digital format. The printed copy of the bill should be provided to the transporter who will carry it throughout the trip till it is being handed over to the consignee.

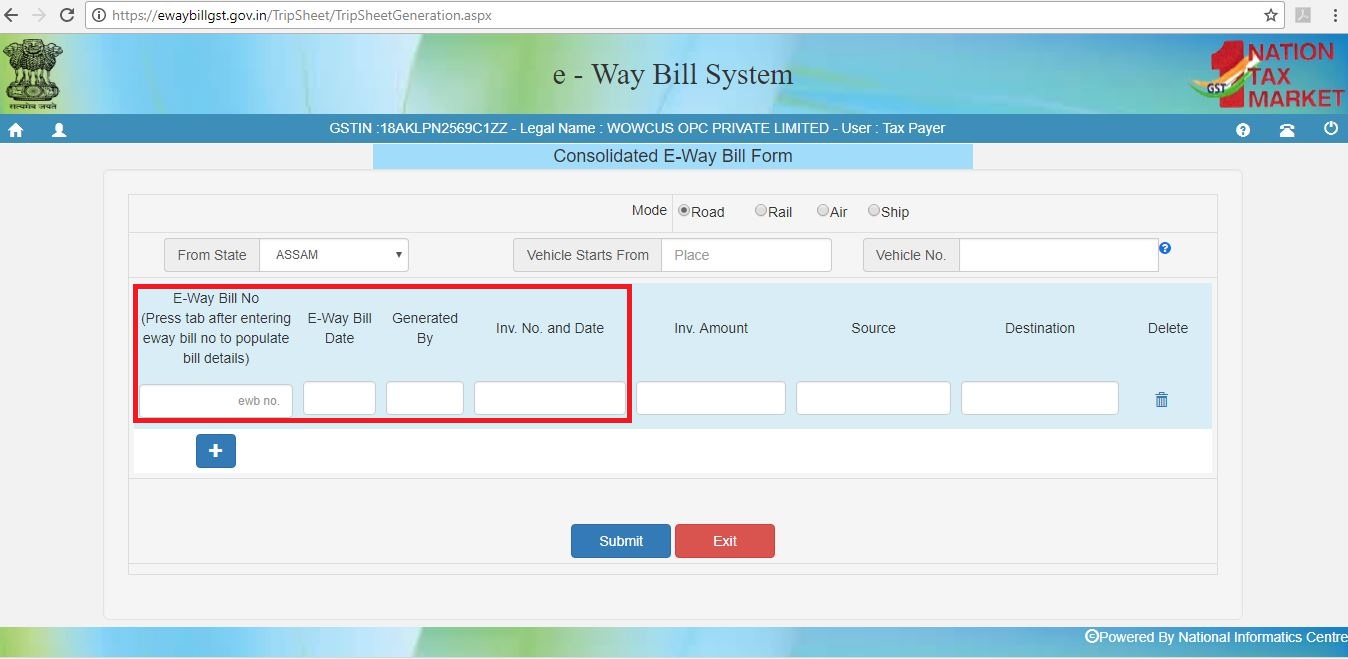

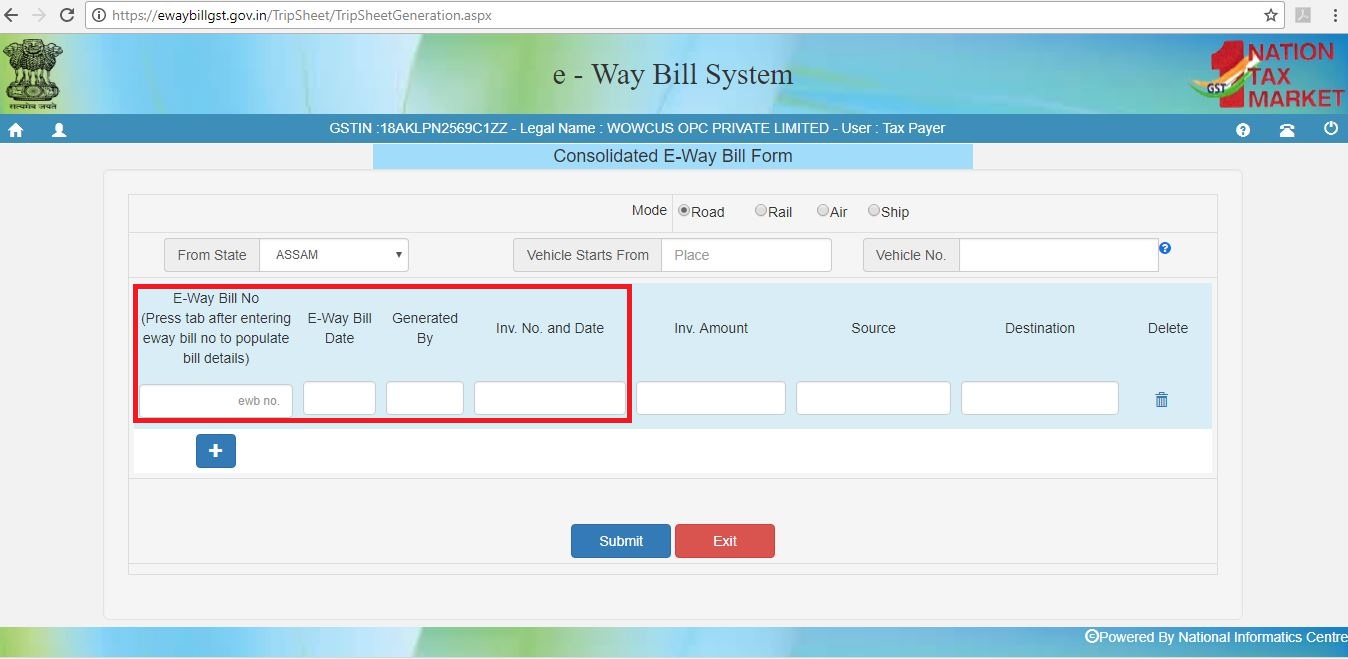

Step 6: Consolidate E-way Bill Generation

A consolidated eWay bill can also be created which contains all the details on the transaction and is also easy to generate it by providing just the ‘eWay bill number’ in the required field. Click on “SUBMIT” to generate the consolidated eWay Bill.

An eWay bill can be updated once it is created. Details on the transporter, consignment, consigner and also the GSTIN of both the parties can be updated in the existing eWay bill provided the bill is not due on its validity.

CAclubindia

CAclubindia