REFUND OF TCS

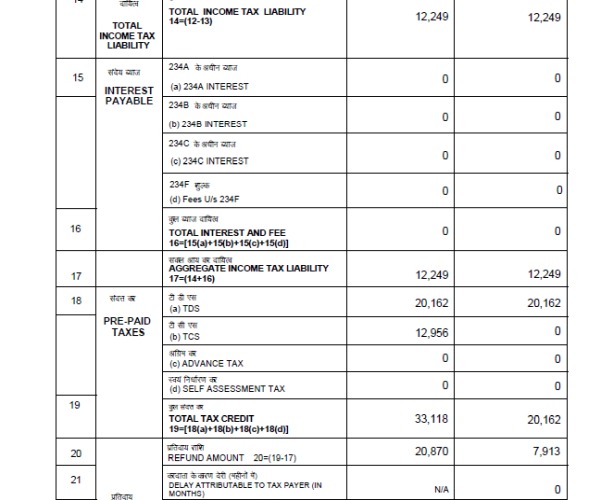

I filed return which contains TDS & TCS refunds of rupees 8000 and 12000 respectively. But after assesement I only got TDS refund of rupees 8000 and TCS refund is not given to me.

Why what is the reason for that, can I get that refund by filing a revised return?

The TCS amount is the amount which is collected during purchase of car.

CAclubindia

CAclubindia