Hi All,

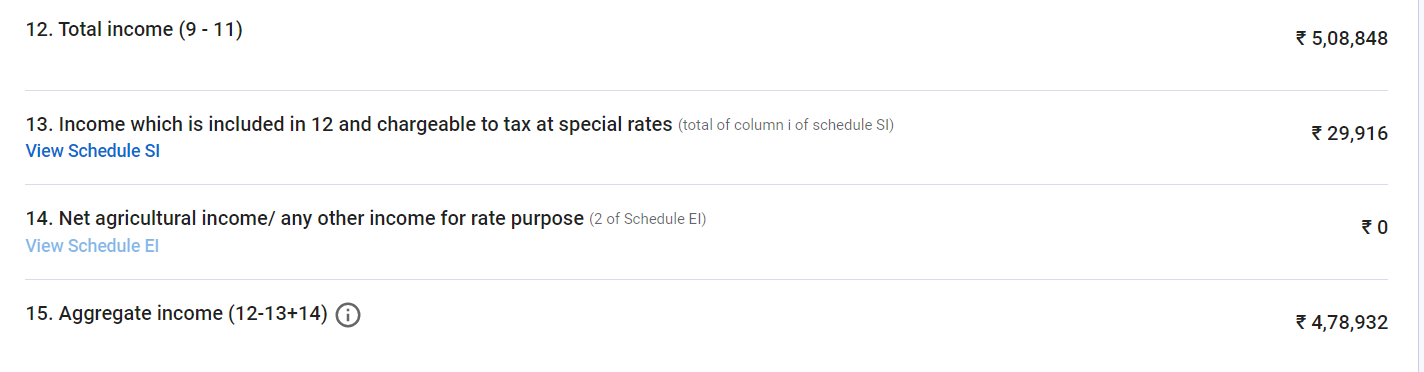

I am filing ITR2 since I have LTCG on sale of shares along with Salary Income. LTCG is Rs 29,916 and so not taxable. My taxable income without considering LTCG is Rs 4,78,932. In ITR 2, in the Computation of Total Income section, I see the following:

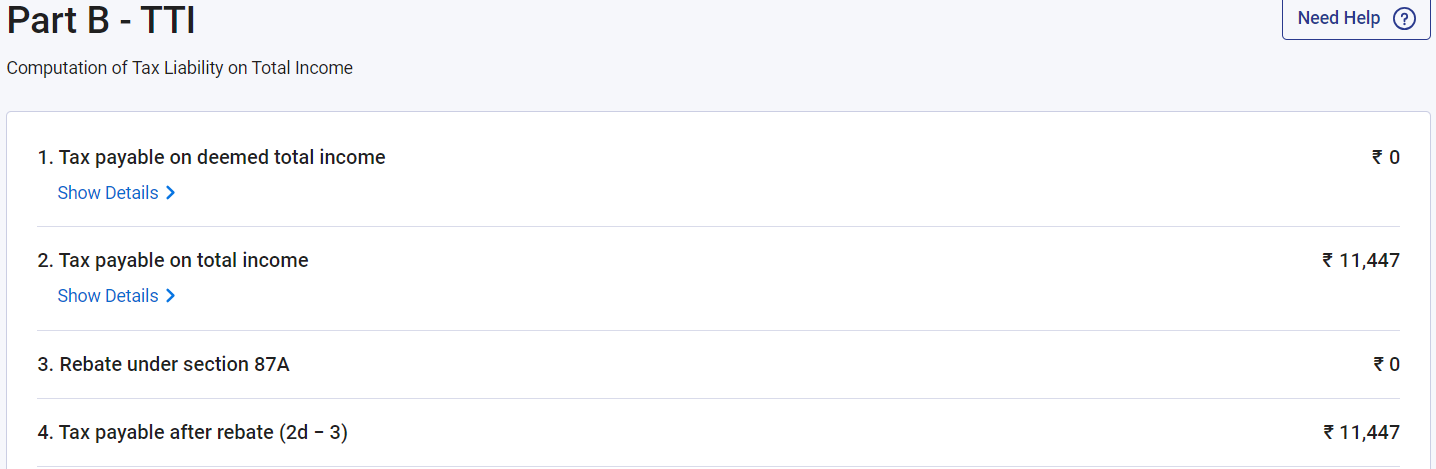

When I go into the final section, Computation of Tax Liability on Total Income, below is what i see :

Why am I denied Rebate under 87A ? Is this a bug in the implementation of ITR 2 ? If so, how to get this fixed ?

CAclubindia

CAclubindia