I was withdraw my EPF & Pension Fund which A/C was open on 26-May-2008 and continue Till 10-sep-2011 .After I will change my job but did not transfer my PF . Now I was withdraw my EPF & Pension Fund almost after 7 Years of A/C opening .

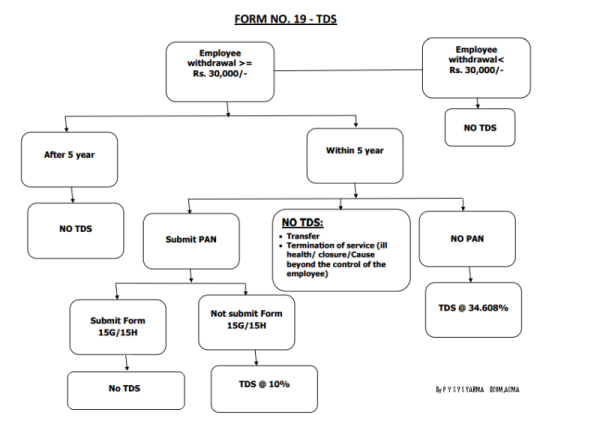

But EPFO was deduct TDS from my PF at 10 percent because PAN & Form-15G/H not submitted with withdrawal form .

My Query is that

1) Is amount received from PF & Pension amount is taxable , If So then how much because my current tax slab is 30% ?

2) Is there is any way this amount is converted into not taxable means reinvest or transfer this amount to existing PF A/C after withdraw?

CAclubindia

CAclubindia