Hi,

I am an exporter of services. I get payment through paypal.

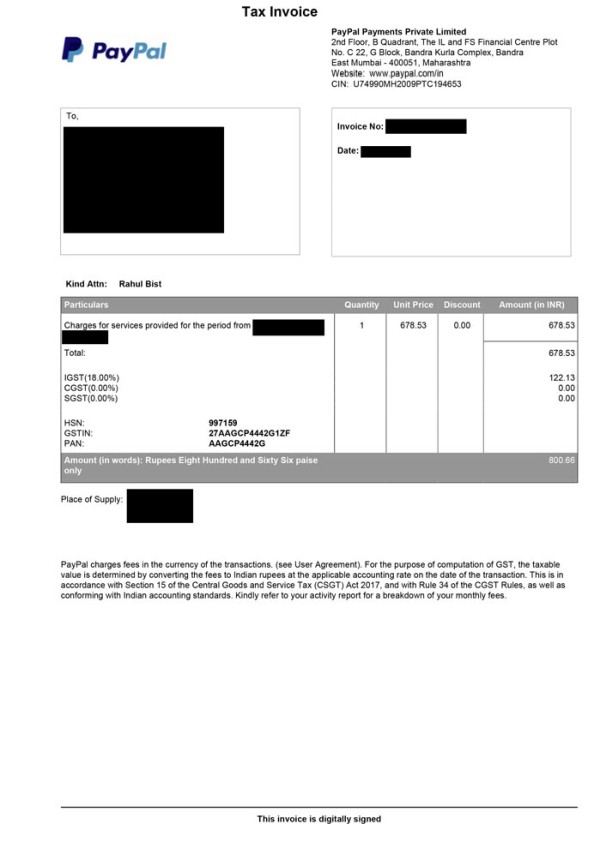

Paypal pays IGST at 18% to govt.

Problem is , Paypal was paying IGST but, I gave my gst number to paypal later. But, for months when I didn't added my gst number to paypal account. the amount is not reflecting in GSTR 2A.

what should I do?

Should I file nil return in GSTR 3B? if yes, how, I will reflect the transaction in GSTR 1?

I am adding a paypal invoice for reference.

please help me.

thanks

CAclubindia

CAclubindia