Student CA Final

122 Points

Joined July 2013

Hello

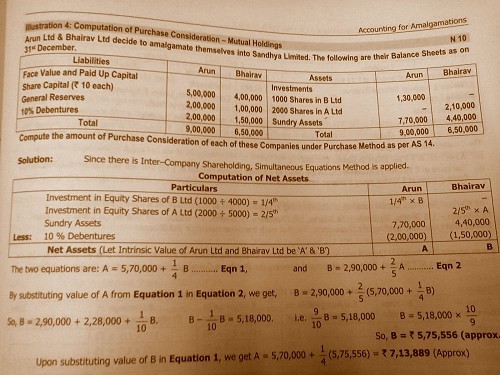

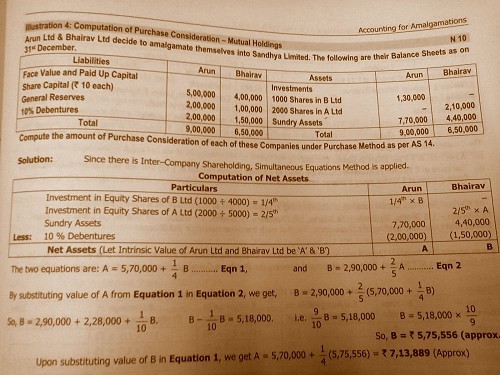

Lets understand this from Arun ltd.'s point of view.

Purcahse Consideration (by net asset method) = Sundry Assets -Sundry Liabilities. (in Bhairav's balance sheet)

Now Arun ltd's has shares of Bhairav ltd. which is for them , but the value of these investments (i.e. share of the 1000 Bhairav ltd.) reflect book value, not the intrinsic value.

INTRINSIC VALUE This is the amount which equity shareholders will get on winding up.

Intrinsic value of shares of Bhirav ltd = x(let)= Assets- Liabilities-Preference Shares(i.e. equity shares + reserves is intrinsic value)

Now, value of investments held by Arun ltd = x*1000/4000

Similarly Bhairav ltd. holds shares of Arun ltd.

In this case assume intrinsic value of shares of Arun ltd. = y and do the calculations by forming simultaneous equations.

If you are still in doubt, post further.

query why in above question while calculating total assets why investment of arun and bhairav(given in B/S) is not added why simultanous equation is used..

query why in above question while calculating total assets why investment of arun and bhairav(given in B/S) is not added why simultanous equation is used.. query why in above question while calculating total assets why investment of arun and bhairav(given in B/S) is not added why simultanous equation is used..

query why in above question while calculating total assets why investment of arun and bhairav(given in B/S) is not added why simultanous equation is used..