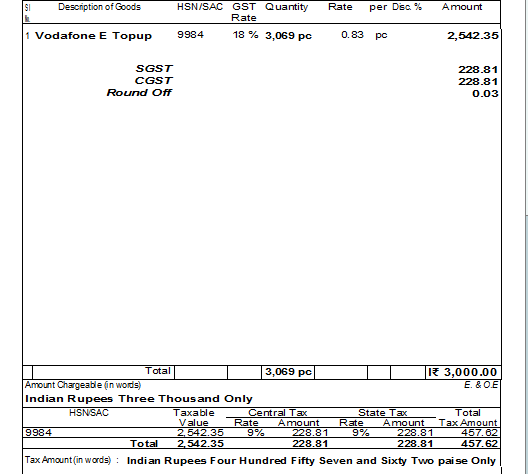

above is the invoice recd from distributor for vodafone top up.now when a retailer sells the total value in a single day i.e 3069 , what exactly is he supposed

to do. will he issue a bill for 3069 and charge gst , then his assessable value is 3069/1.18=2600 and tax will 2600*18/100=468, which is 2600+468=3068 approx.

he will deposit tax on 69 which will be 11 approx. question is which part will be the turnover .3069 or only 69.

CAclubindia

CAclubindia