Menu

Journal Entry of credit note

in sales invoice

Taxable amount 12000

CGST. 1080

SGST. 1080

Bill amount. 14160

Less CN 500

net amount. 13660

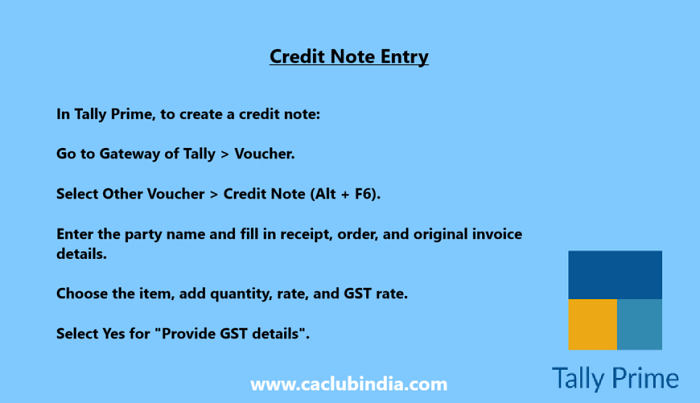

how to show this transaction in tally prime

Taxable amount 12000

CGST. 1080

SGST. 1080

Bill amount. 14160

Less CN 500

net amount. 13660

how to show this transaction in tally prime

Replies (7)

Recent Threads

- TDS u/s 194J - training honorarium

- WHERE TO REGISTER UNDER PTRC AND PTEC ACTS ?

- Key Corporate Compliance Requirements for Private

- Gst Non Filling Return Notice

- GSTR 2B ( MULTIPLE MONTHS )

- Eway bill generation for export material.

- International Tax clarification UK.

- E way bill expired penalty

- Best SME Focused AIF Funds in India for High Growt

- How does employee management software help in stat

Related Threads

CAclubindia

CAclubindia