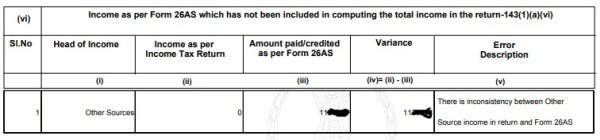

I AM DOING PAYMENT COLLECTION AGENCING RECEIVED THE COMMISSION FOR THEIR PAYMENTS THEY DEDUCT TDS @ 5% UNDER SECTION 194H.I FILED ITR-4 FOR THE AY 2017-18.NOW I RECEIVED NOTICE 143(1)A MISMATCH ITR & 26AS. THEY SAID I AM NOT SHOWING OTHER SOURCE OF INCOME ASPER 26AS STATMENT. BUT I AM SHOWING INCOME FORM BUSINESS WITH MORE 8% PROFIT FOR TRANSACTION VALUE.PLEASE GUIDE ME MY RETURN IS WRONG OR CHANGE TO ITR FORM

WITH REGARDS,

SANKARADHAYALAN

Attached File : 1272486 20180514181218 income.jpg downloaded: 167 times

CAclubindia

CAclubindia