Menu

ITC reversal when ITC wrongly claimed

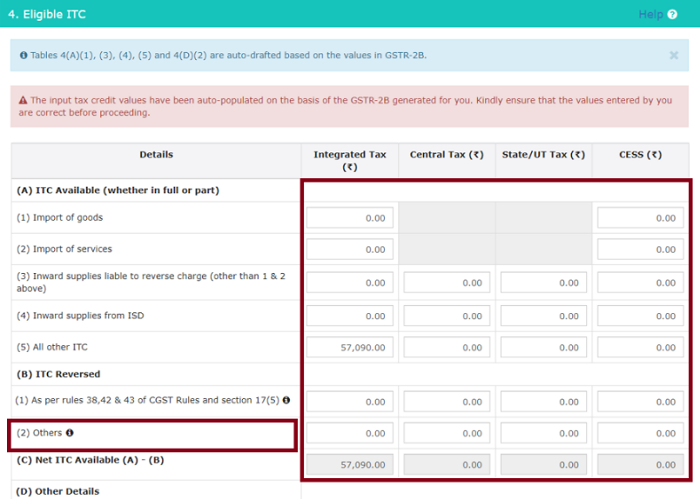

A restaurant business mistakenly claimed input tax credit (ITC) on an invoice with a 5% GST, which is not eligible for ITC under GST regulations. Please advise on how to reverse this ITC, and whether interest and penalties will apply? Please provide relevant sections for reference.

Replies (2)

Recent Threads

- Change HSN

- TDS ISSUE ( DIFFERENT SECTION )

- Company strike off with loan waiver accounting iss

- Board resolution for authorization for GST

- Invoice related audit

- Gst input credit related

- Updated ITR as missed the dead line

- Change if place of business l

- Purchase from unregistered dealer garments busines

- TDS DEDUCTED BUT NOT PAID BY EMPLOYER

Related Threads

CAclubindia

CAclubindia