Dear All,

Pleae let me know is bad debts allowable expenses as per income tax.

We have raised a invoice in year 2011-12 for the amount 5 lac towards event managemnet service & till now we did not recived amount now we want to write off that amount .

Please help me

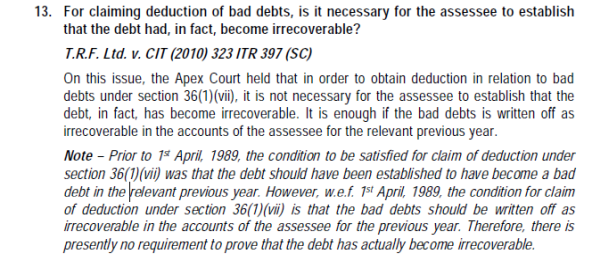

... there is any cas law so that i can show him

... there is any cas law so that i can show him

CAclubindia

CAclubindia