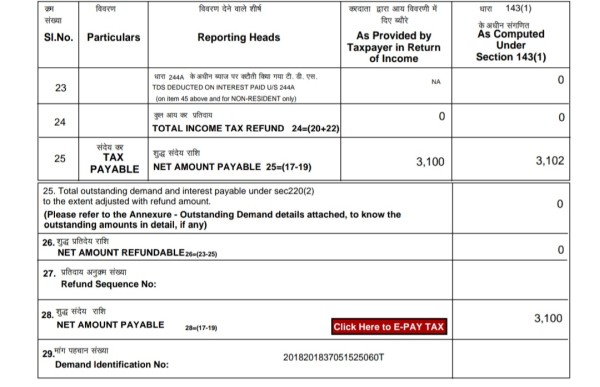

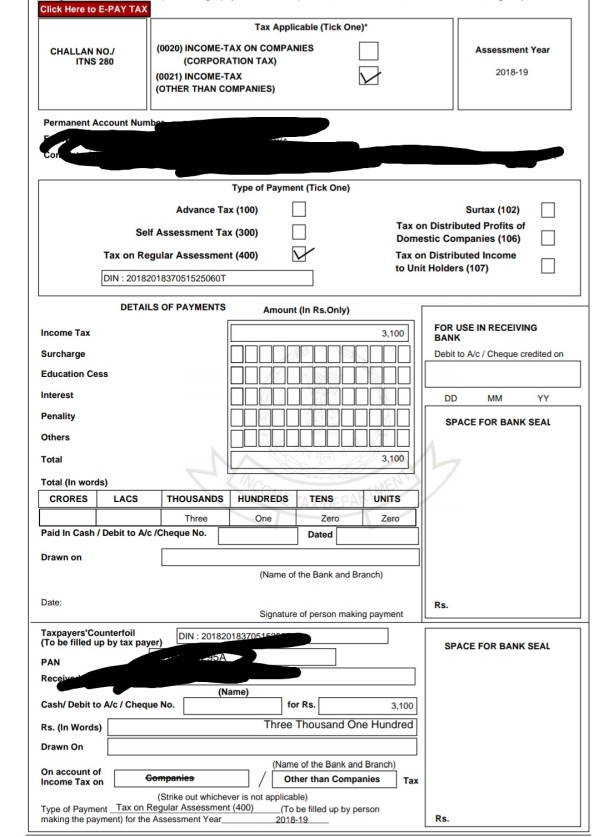

I just received intimation u/s 143(1) from income tax dept. I had filed last year's ITR and paid the excess tax of Rs 3100 from direct link at the portal.

In the intimation, there is a demand of Rs 3100 which I already paid (it is also acknowledged in the intimation itself with the challan details), so I am not sure what to do. Am I supposed to rectify or do anything? Below are some screenshots from the intimation pdf for reference (sensitive info hidden):

CAclubindia

CAclubindia