Menu

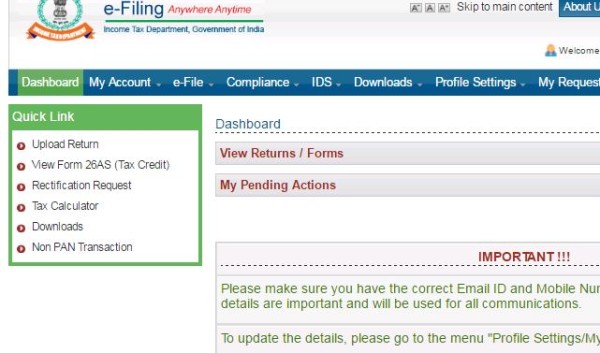

How to submit the demand of tax credit mismatch?

Sir,

Please advice me, i have Tax credit mismatch for which demand rise Rs 4800. i have paid the demand and its shows again rectification processed Demand determine please advice what should i do?

Replies (24)

Recent Threads

- Are AI tools like ChatGPT actually useful for CA w

- UK TAX (HMRC) HELP WITH INVESTIGATIONS, DISPUTES,

- Payment processor not transferring or refunding pa

- Form 16 format

- 17(5) Blocked ITC

- Transfer of equity shares to original owner

- Login credentials and payment acknowledgement not

- Export sales not realised payment not received fro

- Capital gain account amount utilisation

- Form 26QB – Section 194-IA: TDS on Full Cons

Related Threads

CAclubindia

CAclubindia