Steps to resolve Error "54F:

Step 1: Fill the 112A details (through separate schedule)

Step 2: Fill Table D below for Section 54F with the amount you want to claim

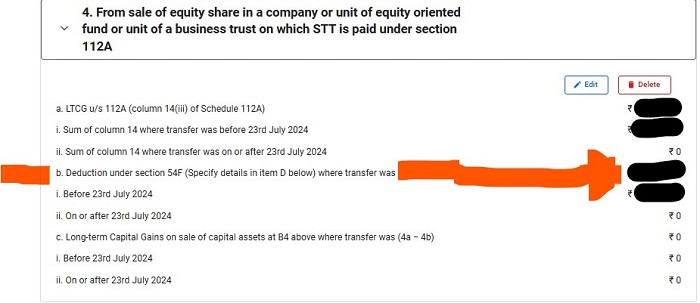

Step 3: Again Edit the below for 112A and enter same 54F Amount under this. Once you do this you will notice that the LTCG becomes Zero and this is the final step. Hurray your Verification and Validation error becomes zero. But hey don't forget thet that in Table F for accrual of Capital Gain , do not enter any value and enter zero only as not LTCG is now due for taxable.

Step 4: Zero Amount to be mentioned if claiming full deduction of LTCG under 54F

CAclubindia

CAclubindia