I am Filing ITR 1 Form by way of Prepare and Submit Online ITR In Incometaxindiaefiling.gov.in.

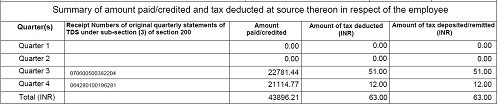

In TDS Tab, Sch TDS1 is automatically filled But ony only Quater 3 .

.jpg)

So, How to Fill This?

What do you Mean By Amont Paid/ Credited In Form 16?

What amount shoud I Fill In "Income Chargeable Under The Head Salaries"?

Thankyou.

CAclubindia

CAclubindia