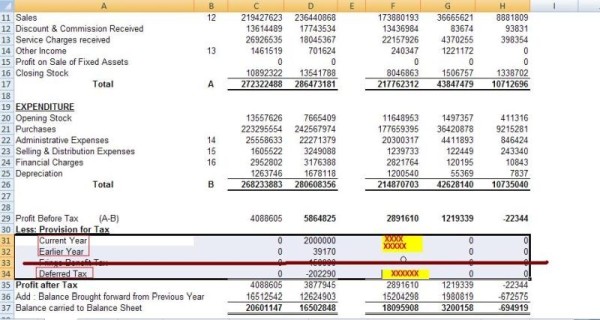

KINDLY HELP ME OUT IN COMPUTING PROVISION FOR TAX & DEFERED TAX COMPUTATION WITH THE DETAILS BELOW

PROFIT OF THE COMPANY BEFORE TAX (PBT) : 40,88,605

DEPRECIATION AS PER COMPANIES ACT : 12,63,746

DEPRECIATION AS PER IT ACT : 13,46,238

PLS FIND THE IMAGE BELOW & HELP ME TO FILL THE BOX

P&L Image

B/s Image:

ITS URGENT KINDLY RENDER A SOLUTION

CAclubindia

CAclubindia