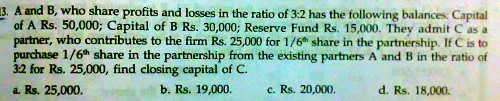

Here in this question, it’s a game of language.. You have to understand question very carefully…

See question says C is to purchase 1/6th share in partnership from A & B in the ratio of 3:2 for INR 25000.. It means the capital of C after all adjustments will be something which is in proportion to capital of A&B.. And question is asking for closing capital of C and not capital after admission.

Before C comes all revaluation activities will take place and here only one item is there i.e. reserve fund. It will get credited to A&B in ratio of 3:2. Now the capital of A will be 59000(50000+9000) and B will be 36000(30000+6000)..

Now the total capital of old firm (A& B) will be INR 95000(59000+36000). So now calculate total capital of the new firm after adjustments (A, B & C).

Total capital of new firm = 95000* 6/5(reciprocal of remaining share 5/6)

= INR 114000

So now C closing capital will be = 114000* 1/6

= INR 19000

Hope you have understood...