Hi,

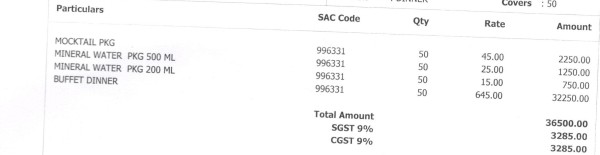

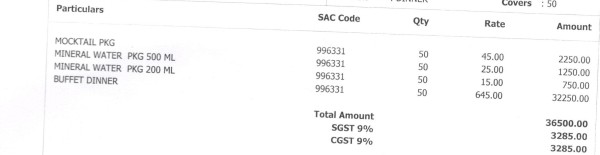

Can I avail GST Input Credit paid on Dinner Conference of IT company employee meet at hotel as it was for business purpose ? Bill contains all food items in particulars of supply of goods.Screen shot is attached above.

Hi,

Can I avail GST Input Credit paid on Dinner Conference of IT company employee meet at hotel as it was for business purpose ? Bill contains all food items in particulars of supply of goods.Screen shot is attached above.