Sir,

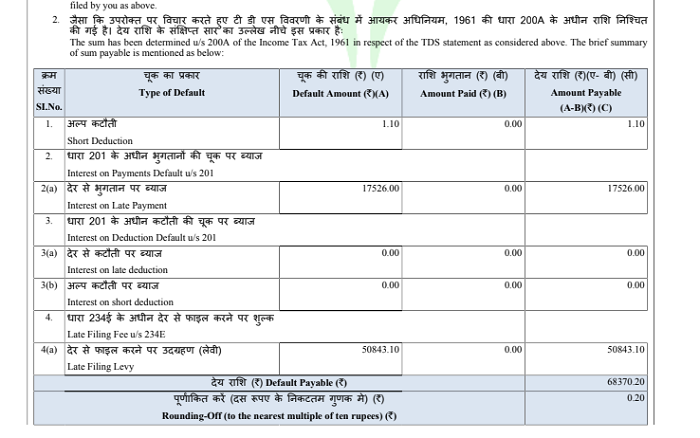

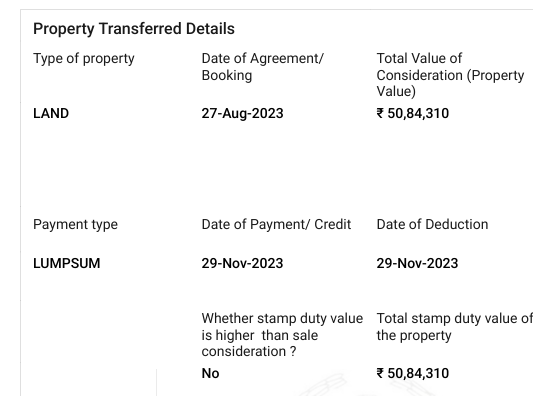

I purchased plot from BDA, for which i have paid the total dues on 29.11.2023, but registry was not done by seller because site was not prepared, Now i have received letter from BDA in September 2025 to pay extra alloted land charges and to deposit 1% TDS after then registry of plot will be done. I have paid extra land charges on 23.09.2025 and filed 26QB (attached) with on 25.09.2025, but now i have received demand(attached) more than TDS amount. Now i am filling correction statement in traces, but still in confusion about the correct values to enter to avoid penality. One more thing i have raised the issue in grivances and now i am able to download form 16b from traces, do i need to file correction statement or not?

CAclubindia

CAclubindia