Dear Sir

One of my client want to file your ITR of AY 2011-12 But he didn't know his registered email id/ security question.

Then I have sent email to validate @ incometaxindia.gov.in on dated 13 sept 2013. But I did not getting any response.

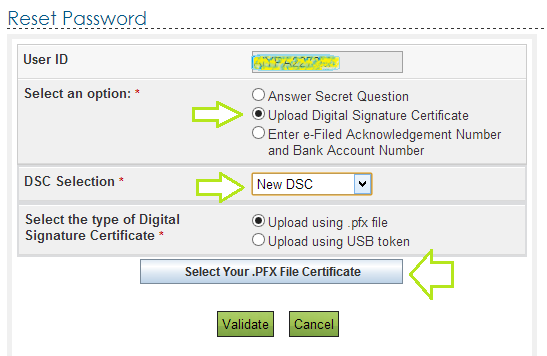

When I call on Toll free no. they told me that they have sent temp. possword to his registered email_id and there is no other method to getting password except by DSC.

Kindly suggest me what to do in that case.

CAclubindia

CAclubindia