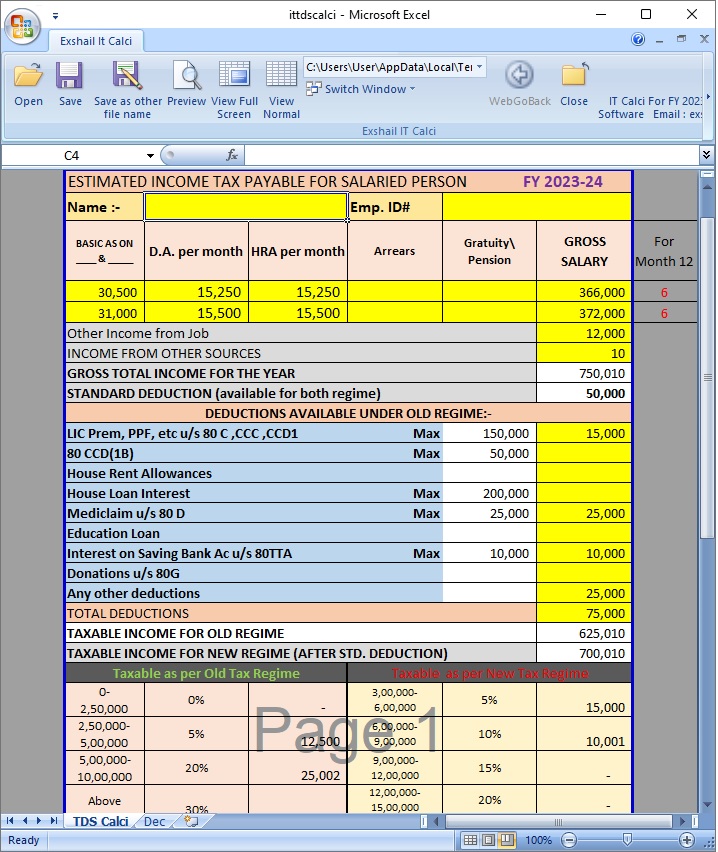

Attached zip file have Excel based utility to calculate monthly tds to deduct from Employee's salary for the current financial year i.e. FY 2023-2024 as per above screen-shoot. It also calculate marginal relief for small tax payer crossing 7 lakh income and not getting 87A deduction which is limited to Rs. 25,000/-..

Unzip to your working folder and run ittdscalci.exe which will load excel file ittdscacli.xlsm (which is for security reason protected and can't be open directly from folder or from within excel's open dialog.)

You can save the excel file with save as other file name option from ribbon but you still need to run first exe file to open the saved file. Zip file includes readme file for more info. This files calculations of TDS working are still need to confirm from your CA professionals. Any suggestion are welcome.

Attached File : 58368 20230703204554 ittdscalci.zip downloaded: 70 times

CAclubindia

CAclubindia