Dear all,

Is there any way to enter service tax amount directly by calculating 15% of entered professional fees above.

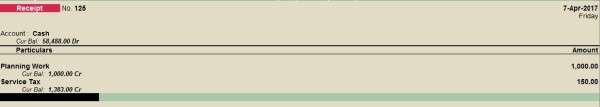

e.g., when I enter Receipt for

consulting engg. service of Rs. 1000

In next step when I select "Service Tax", it should be writted direclty as Rs. 150 against it...

I think there should be a way to do it. But I am not able to figure it out in tally.

Please guide me....

CAclubindia

CAclubindia