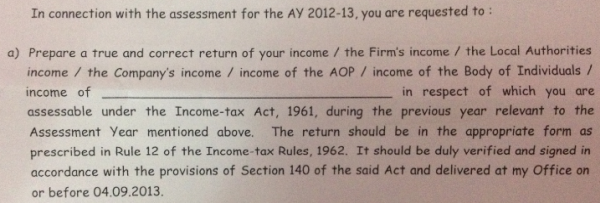

"Prepare a true and correct return of your income... in respect of which you're assessable under IT Act 1961 during the previous year relevant to the Assessment year mentioned above."

What does this mean? I have already filed the returns for FY 11, 12, and 13. My FY 13 income was double the FY 12 and paid the tax as well. So what does this mean?

I got this notice today and the CA is out of town so I can ask him after few days only...

Any help will be appreciated!

Thanks!

CAclubindia

CAclubindia