Hi,

I just filed ITR1 online with my two form16. It says I have to pay remaining tax of some amount. So i googled about it and got this link. But not sure which challan/form I have to choose.

https://onlineservices.tin.egov-nsdl.com/etaxnew/tdsnontds.jsp

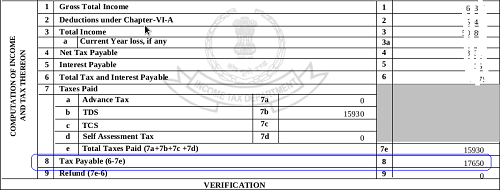

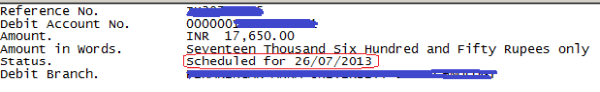

Can any one point me the right direction? I am attaching screenshot of ITR-V. Please see "Tax Payable (6-7e)" which i need to pay it online (Amt: 17650)

Any help much appriciated.

-cmo

CAclubindia

CAclubindia