How to get CPE Credit through CACLUBINDIA

This article is all about the CPE Credit, but the article is more connected with the CPE credit hours of unstructured learning.

Chromaticity of the professional of chartered accountants is because of their knowledge and diversified working style. This is a high dignity and globally recognised profession as its not like other professions where there is no need to update the related knowledge after getting the degree; a chartered accountant should learn continuously even after getting the CA degree. Therefore, the Continuing Professional Education (CPE) Committee of ICAI has introduced a scheme for Continuing Learning Requirements to be quantified in term of CPE credit hours for the rolling period of three years starting from thecalendar year 2008.

Continuing Professional Education (CPE) Requirements

![]() Practicing Chartered Accountant (except those members who are residing abroad or other otherwise exempted CA), are required to complete:

Practicing Chartered Accountant (except those members who are residing abroad or other otherwise exempted CA), are required to complete:

At least 90 CPE hours in each rolling three-year period of which 60 CPE credit hours should be ofstructured learning.

Minimum 20 CPE hours of structured learning in each year.

![]() Chartered Accountants in job or residing abroad, unless otherwise exempted, are required to complete:

Chartered Accountants in job or residing abroad, unless otherwise exempted, are required to complete:

At least 45 CPE hours of structured/unstructured learning in each rolling 3 years period.

Minimum 10 CPE hours of structured/unstructured learning in each year.

It means for rolling period of 3 years, maximum of 30 CPE credit hours of unstructured learning areuseful to accomplish the above requirement for a practicing CA, although there is no maximum limits for accumulating credit of CPE hours from any of above mode.

On the other side, a chartered accountant in job can complete his CPE credit hours requirement through any of structured or unstructured learning mode.

Structured learning mode

The structured learning program is being organized by the ICAI and its committees where credit of CPE hours are being set on some rules based on type of organized program, e.g. recent international conference in Agra; weekly, bi-weekly or monthly meetings in branches etc.

The credit for this type of learning is being given automatically, if a CA is present in the organized program.

Unstructured learning mode

Unstructured learning (ULAs) program is divided in eight types of major activities:

|

1. Web Based |

2. Self learning |

|

3. Home Study |

4. Discussion on technical issues |

|

5. Acting as faculty |

6. Teleconferencing program |

|

7. Questionnaires/Journals |

8. Internal Training Program |

The CPE Credit thru this mode is available for any correspondence course; listening Audio CDs purchased from ICAI; Reading and Individual Home Study including reading articles in the CA Journal, reading technical, professional, financial or business literature; Group or bilateral discussion on technical/professional issues; working as a faculty member in any college, university or a management or national importance institution; internal training program organized by CA firm with more then 6 partners.

Claiming CPE Credit hours of unstructured learning

A chartered accountant can claim CPE credit hours of unstructured learning activity (ULA) through self declaration form, available at ICAI website and caclubindia portal. Within 5 Months of close of a calendar year (e.g. For calendar year 2009 form can be submitted upto 31.05.2010) duly filled-in and signed self declaration form to be submitted to the concerned Decentralized Offices and On the basis of Self Declaration submitted by the Members, the concerned Decentralized Offices would enter the CPE Hours Credit on the CPE Portal under the Head Unstructured Learning Activities (ULAs).

However, the CPE Advisory can accept, reject, or reject partly, the said claim.

Documentation Is it needed ?

The Chartered Accountants would be required to fulfil the documentation requirements as mentioned in this advisory, to avail respective CPE Credits. The Members would also be required to maintain and retain proper records of ULAs undertaken by them, i.e. Type of unstructured activity, topic, date and the number of CPE hours requested by them.

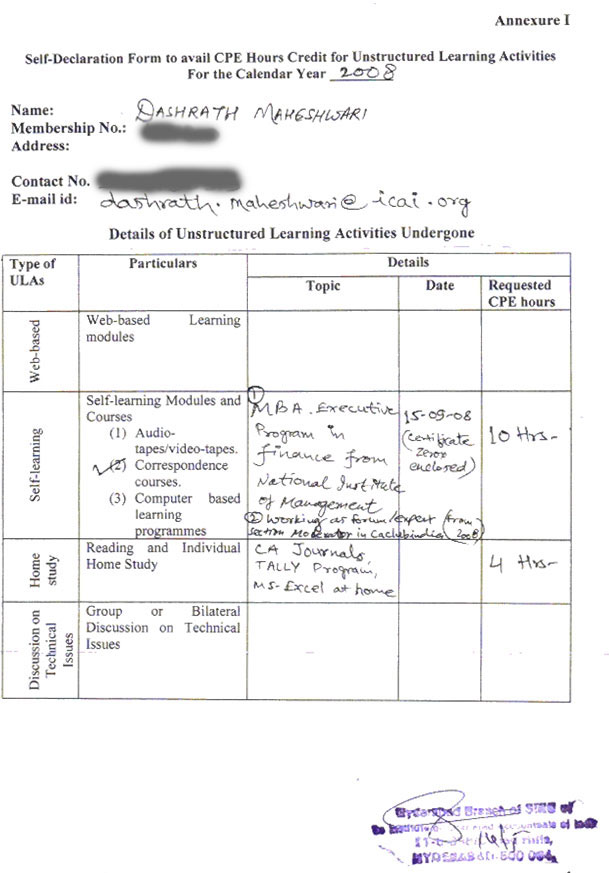

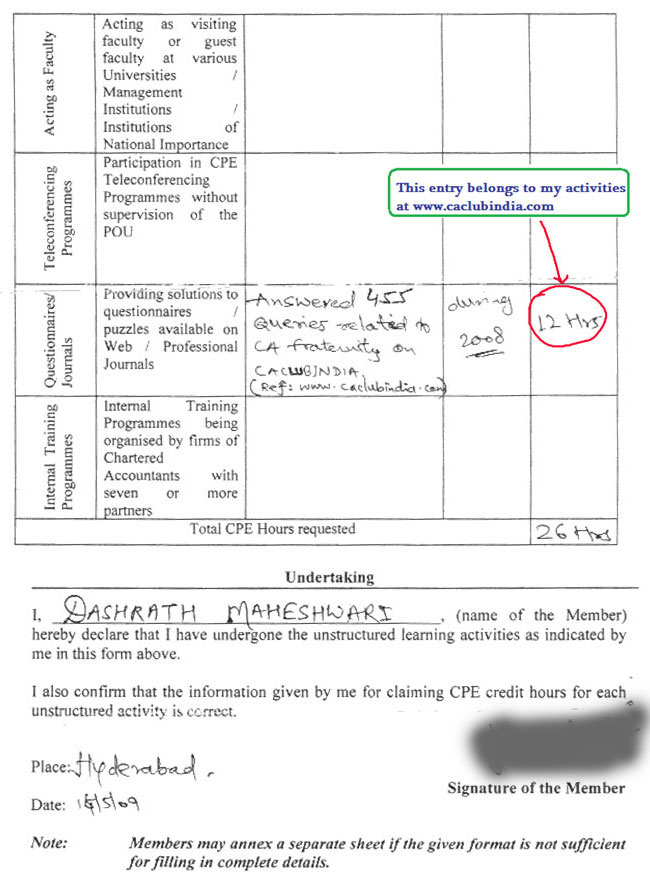

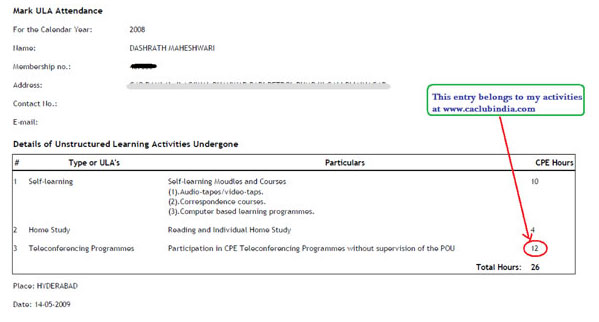

How I got the CPE credit

I would like to share my experience of getting CPE credit for the expert opinions provided in EXPERT Section of www.caclubindia.com.

I have sent my claim for CPE credit through Self Declaration Form to the nearest branch of ICAI. In that form, I have claimed 12 hours of answering CPE Credit for the 455 queries related to chartered accountants fraternity during calendar year 2008 and my claim has been approved by the ICAI, CPE Committee.

I thank to ICAI for giving recognition by extending CPE credit hours to me for this activity and sharing of knowledge through e-initiative. The ICAI is created a new path for the professional development of the members by this act.

I evince CA PARIVAR to share the knowledge between members and students through the especially designed, well equipped, finely presented CACLUBINDIA portal.

I reckon that sharing and gaining the knowledge was never so fruitful and I would like to request to all the members of CACLUBINDIA, who are chartered accountants, to claim only unfeigned CPE credit of unstructured learning, so that we can put forward for recognition to CACLUBINDIA from the ICAI for this mode of CPE Credit. The chartered accountants are required to indicate the time devoted to the ULAs in the areas that are related or relevant to the profession, in the Self Declaration Form.

Now, I drop my pen down by expressing my special thanks to Admin and tech-team ofwww.calubindia.com for providing such a nice platform for streaming the knowledge. And I also thank to members of the portal for devising www.caclubindia.com a very big knowledge exchange portal.

Attached:

1. My claim (Self Declaration form),

2. Copy of my certificate,

All Credit of this Post Goes to by CA. Dashrath Maheshwari

CAclubindia

CAclubindia