Hey,

If a couple (Husband-Wife) bought a house and they are Co-owner of house in ratio of 60:40. Both are earning person. wife took a home loan on its own name from bank. (Not a joint loan).

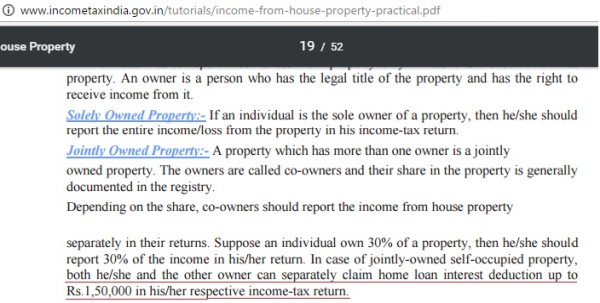

So whether both of they are eligible deduction u/s 24b and 80C or only wife.

if Both then in which ratio?????????????

Is it mandatory to be a Co-borrower????

CAclubindia

CAclubindia