student

265 Points

Joined August 2016

Dear Shweta,

Let's understand few concept before analysing about the type of expenditure..

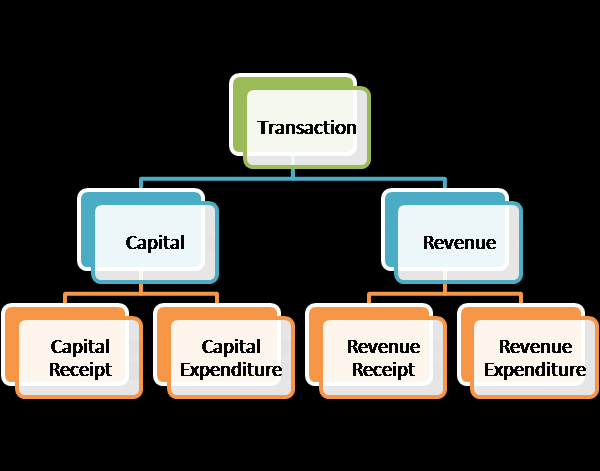

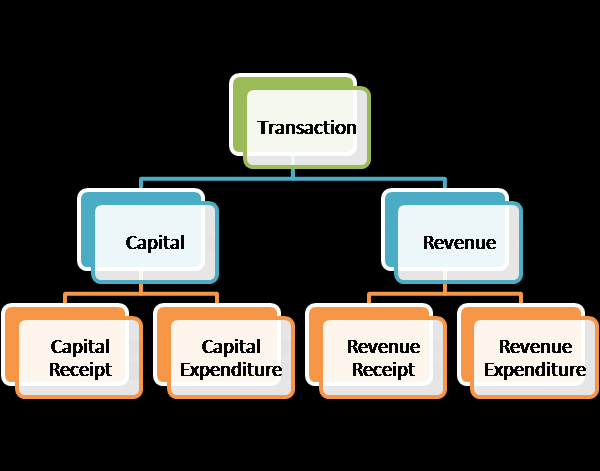

Business transaction is of 2 types:

Apart from this there is Deffered Revenue Expenditure.

Since you are asking about the expenditure so i am writing here only about Expenditure..

Capital Expenditure:

Those expenditure which gives benefit for more than one year. For e.g.,

- Fixed asset purchased,

- Any expenditure on fixed asset which increases PROFIT either by way of Efficiency increase or Reduced cost of operation or both.

Revenue Expenditure:

Those expenditure which gives benefit for one accounting year only. For e.g., Compensation paid to employees.

Deffered Revenue Expenditure:

Those expenditure which gives benefit for more than one year AND expenditure not incurred on Fixed Asset.

Whether a particular expense is CAPITAL or not, in order to find the answer of this question check following conditions ...

- Exp. must give benefits for more than ONE year AND

- Exp. must be on FIXED ASSET

- Exp. must increase the PROFIT

- Expenditure must increse the value of ASSET.

If above conditions is satisfied then it is capital in nature.

ANSWER TO YOUR QUERY

- Capital Expenditure

- Capital Exp.

- Revenue Expenditure

- Deffered revenue Exp.

- Capital exp. ( It is a Capital loss)

For reason please read the whole article. I hope this will help you in order to understand the above mentioned topic....

CAclubindia

CAclubindia