Hi all,

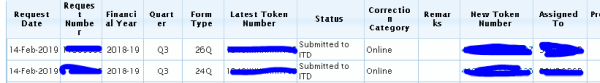

For FY 2018-19 Q3, I filed 26Q TDS return. However, for one challan the entered the deposit date as 4 Nov instead of 4 Dec. The return was processed with an error that TDS has been overbooked by the amount of incorrect challan. TRACES site suggested that I do an online correction. I noticed that I cannot change the date of the incorrect challan from 4 Nov to 4 Dec. However, I could add a new challan and I added the correct challan dated 4 Dec. The correction got processed with error. I have 2 challans for same amount now, but different dates. How do I remove the incorrect challan and correctly process the return?

Please advise.

Thank you

CAclubindia

CAclubindia