Really :O Then how my CA is filling ITR 5 from last 4 years and NO issue came from income tax

Menu

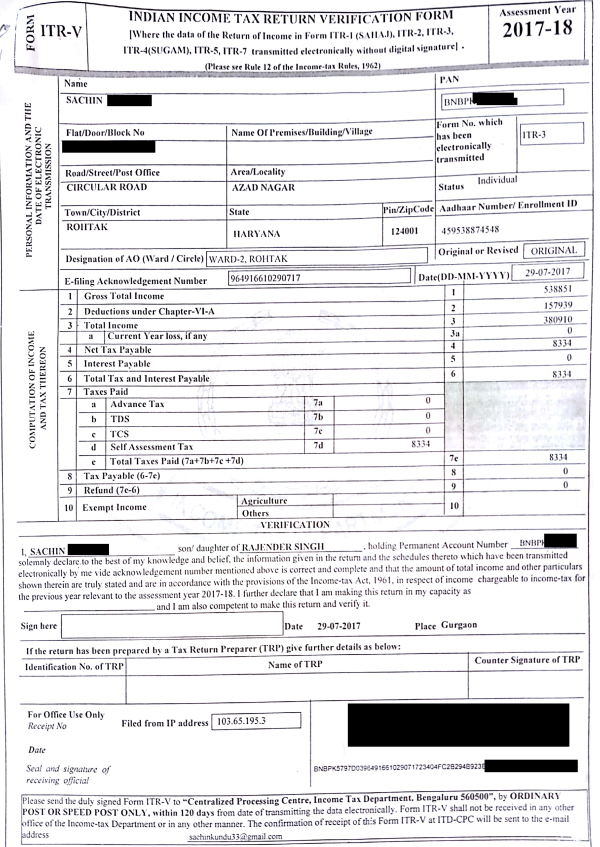

Can i fill itr v or itr 5 myself ? help

Recent Threads

- Waste Management services

- Seeking Clarity: New Transport Allowance Limits (D

- Query regarding Consolidated Gift Deed for Bank Tr

- TDS u/s194IB - Joint Ownership

- Free GST Reconciliation Tool in Google Sheets R

- NRI return after due date refund case

- TDS u/s 194J - training honorarium

- WHERE TO REGISTER UNDER PTRC AND PTEC ACTS ?

- Key Corporate Compliance Requirements for Private

- Gst Non Filling Return Notice

Related Threads

CAclubindia

CAclubindia