Menu

Calculate fd income(cumulative)

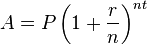

How do I calculate Income from FD with interest paid on maturity(Cumulative Interest) having around 8 years maturity period and report Income from this FD annually in ITR?

Replies (2)

Recent Threads

- Key Corporate Compliance Requirements for Private

- Gst Non Filling Return Notice

- GSTR 2B ( MULTIPLE MONTHS )

- Eway bill generation for export material.

- International Tax clarification UK.

- E way bill expired penalty

- Best SME Focused AIF Funds in India for High Growt

- How does employee management software help in stat

- Clarification Required – Section 18 of Wage

- How to split freelance project income with a frien

Related Threads

CAclubindia

CAclubindia