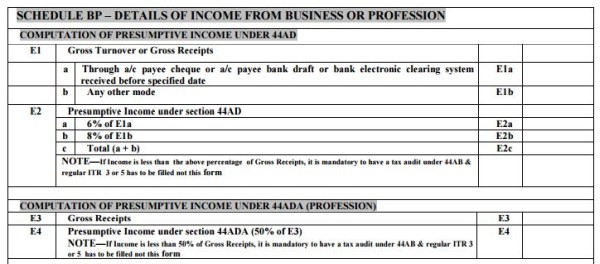

Current ITR has option to Enter Turnover under 44AD in two columns.

1. Bank Channel

2. Other Mode

Does anyone has any brief detail or explanation for both this terms?

otherwise normally it should mean any payment received via Bank or Wallet will be term as Bank Channel... and anything other then will be Other MODE.

So in P/L we will have to show both figures under this mode differently...

What about the Credit Sales, where payment is yet to be received as on 31st March ? What head should it go? Since we are not yet sure about the Mode of Payment for it....

CAclubindia

CAclubindia