CA - Final (ST)

A question from our Online Test Series.

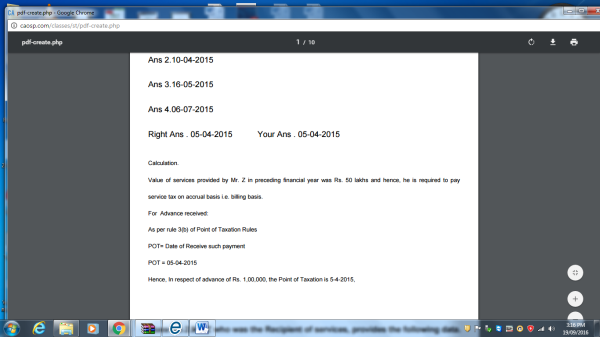

Mr. Z a Service Provider received an advance of Rs. 1,00,000 from Mr. X on 5-4-2015 as part payment for a service. The service was completed on 10-4-2015 and the date of invoice was 16-5-2015. Value of services provided by Mr. Z in preceding financial year was Rs. 50 lakhs. Determine the point of taxation in the above case.

Select the correct ans.

1. 05-04-2015

2. 10-04-2015

3. 16-05-2015

4. 06-07-2015

CAclubindia

CAclubindia