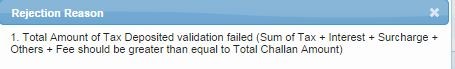

Hi, I am trying to file a correction for form 27Q, while original filing the CA didnt consider the educational cess and now it has come under defaults. Total defaults were 2561Rs. Of which 1600 were for late fees, 865 for defaults and 96 for interest I have paid the defaults using Challan 281 under the Basic Tax (865), Interest (96), and Fee Under sec 234 E(1600) and did the challan tagging in Traces. post that system correctly considered the 1600 Rs late and the defaults amount was reduced by this value. Now when i am filing the returns with changing the deductee details using RPU , the remaining challan amount showing me is 961 Rs (865+96). but when i generate the FVU file the the total tax paid and total amount under challan dont match (difference of 1600 which i cant put in the deductee details). So traces is rejecting the returns with validation that Total taxes paid and challan amount dont match.

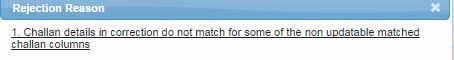

Also where should include the 96 Rs interest in the RPU? there is no column for interest. If i include the entire amount 961 in the TDS column , traces still rejects the return with different error.

CAclubindia

CAclubindia