What is the GST Rate applicable on Job work service?

Last updated: 27 November 2021

Court :

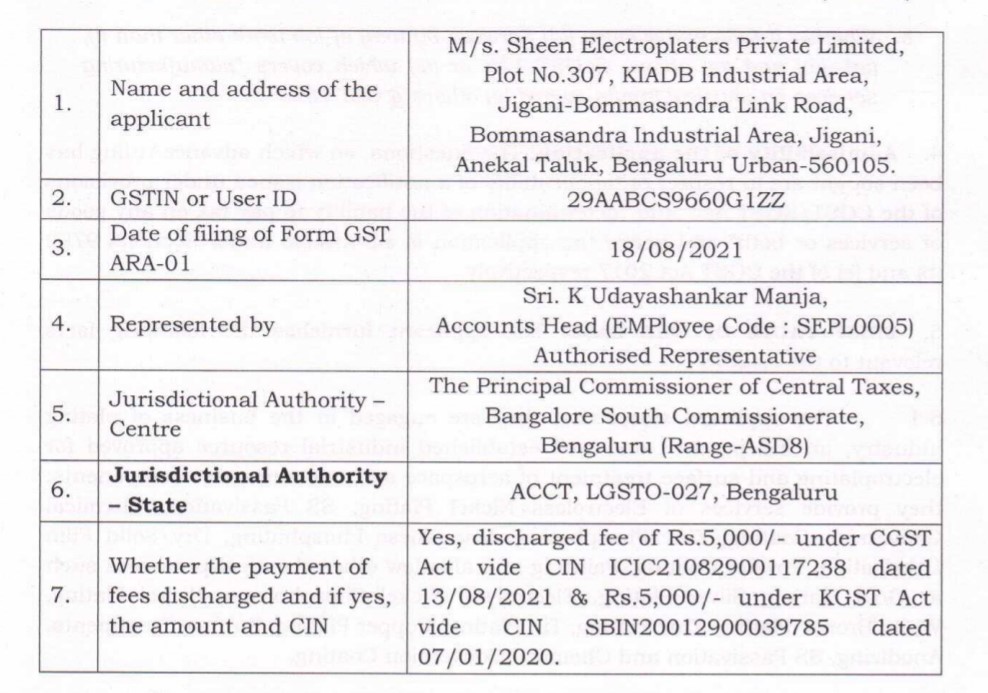

Centre The Principal Commissioner of Central Taxes, Bangalore South

Brief :

Whether if falls under entry (id) Services by way of job work other than (i), (ia), (ib) and (ic) above; at GST 12% or (iv) which covers "Manufacturing Services on physical inputs owned by others at GST 18%?

Citation :

KAR ADRG 53/2021

THE AUTHORITY FOR ADVANCE RULINGS IN KARNATAKA GOODS AND SERVICES TAX VANIJYA THERIGE KARYALAYA, KALIDASA ROAD GANDHINAGAR, BENGALURU - 560 009

Advance Ruling No. KAR ADRG 53/2021 Dated 29-10-2021

Present:

1. Dr.M.P. Ravi Prasad Additional Commissioner of Commercial Taxes . . . Member (State)

2. Sri. T. Kiran Reddy Joint Commissioner of Customs & Indirect Taxes . . .Member (Central)

Please find attached the enclosed file for the full judgement.

Poojitha Raam Vinay

Published in GST

Views : 391

downloaded 255 times

Comments

Trending Online Classes

-

DT & Audit (Exam Oriented Fastrack Batch) - For May 26 Exams and onwards Full English

CA Bhanwar Borana & CA Shubham Keswani

CA Bhanwar Borana & CA Shubham Keswani -

IDT LIVE Exam Oriented Batch | May 2026, Sept 2026 & Jan 2027

CA Arpita Tulsyan

CA Arpita Tulsyan

CAclubindia

CAclubindia