Can a business be exempted from TDS Deduction if refundable excess difference is submitted beforehand?

Last updated: 18 August 2021

Court :

KERALA AUTHORITY FOR ADVANCE RULING GOODS AND SERVICES TAX DEPARTMENT

Brief :

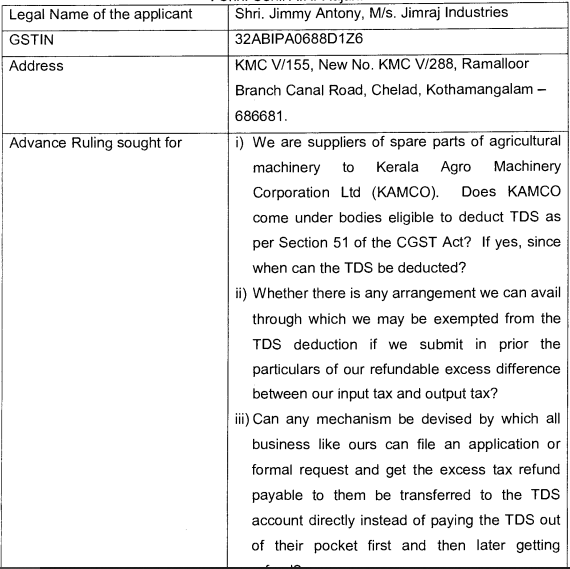

Does KAMCO come under bodies eligible to deduct TDS as per Section 51 of the CGST Act? If yes, since when can the TDS be deducted?

Citation :

KER/98/2021

KERALA AUTHORITY FOR ADVANCE RULING

GOODS AND SERVICES DEPARTMENT TAX, TAX TOWER,

OF :Shri. KARAMANA, THIRUVANANTHAPURAM — 695002

BEFORE THE AUTHORITY Sivaprasad S, IRS& : Shri. Senil A K Rajan

Please find attached the enclosed file for the full judgement

Poojitha Raam Vinay

Published in GST

Views : 86

downloaded 207 times

Comments

Trending Online Classes

-

DT & Audit (Exam Oriented Fastrack Batch) - For May 26 Exams and onwards Full English

CA Bhanwar Borana & CA Shubham Keswani

CA Bhanwar Borana & CA Shubham Keswani -

IDT LIVE Exam Oriented Batch | May 2026, Sept 2026 & Jan 2027

CA Arpita Tulsyan

CA Arpita Tulsyan

CAclubindia

CAclubindia