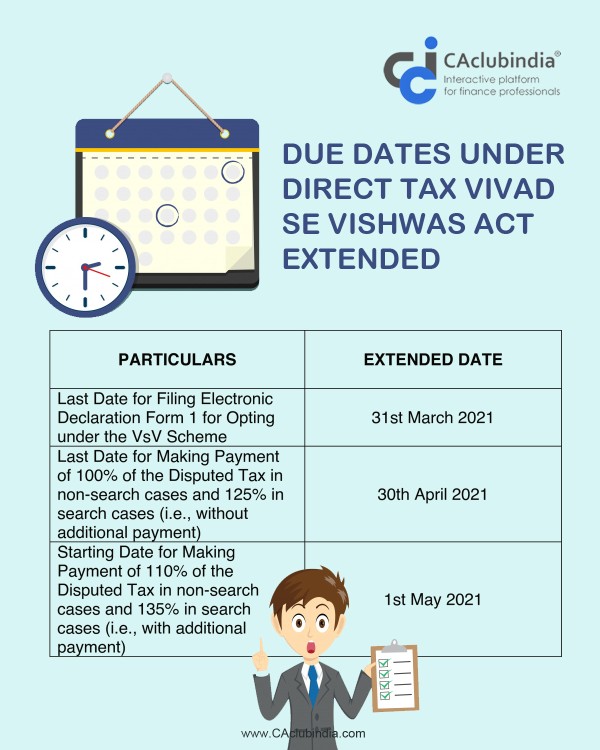

The Central Board of Direct Taxes has further extended the due date for filing declarations under the Direct Tax Vivad se Vishwas Act 2020. Read the official notification and the extended due dates below:

MINISTRY OF FINANCE

(Department of Revenue)

(CENTRAL BOARD OF DIRECT TAXES)

NOTIFICATION

New Delhi, the 26th February, 2021

S.O. 964(E).—In exercise of the powers conferred by section 3 of the Direct Tax Vivad se Vishwas Act, 2020 (3 of 2020), the Central Government hereby makes the following amendments in the notification of the Government of India, Ministry of Finance, (Department of Revenue), number 85/2020, dated the 27th October, 2020, published in the Gazette of India, Extraordinary, Part-II, Section 3, Sub-section (ii), vide number S.O. 3847(E), dated 27th October, 2020, namely:––

In the said notification,––

(i) in clause (a), for the figures, letters and words “28th day of February, 2021” the figures, letters and words “31st day of March, 2021” shall be substituted;

(ii) in clause (b), for the figures, letters and words “31st day of March, 2021” the figures, letters and words “30th day of April, 2021” shall be substituted; and

(iii) in clause (c), for the figures, letters and words “1st day of April, 2021” the figures, letters and words “1st day of May, 2021” shall be substituted.

[Notification No. 09/2021/ F.No. IT(A)/01/2020-TPL]

SHEFALI SINGH, Under Secy.

Tax Policy & Legislation Division

Note: The principal notification was published in the Gazette of India, Extraordinary, Part-II Section 3, Sub-section (ii) dated the 27th October, 2020 vide number S.O. 3847(E), dated 27th October, 2020 and was subsequently amended by notification number S.O. 4804(E), dated 31st December, 2020 published in the Gazette of India, Extraordinary, Part-II Section 3, Sub-section (ii) dated the 31st December, 2020 and notification number S.O. 471(E), dated 31st January, 2021 published in the Gazette of India, Extraordinary, Part-II Section 3, Subsection (ii) dated the 31st January, 2021.

CAclubindia

CAclubindia