What is Transfer Pricing ?????

Transfer pricing relates to the pricing of transactions

(such as transfer of goods, services, intangibles and funds)

It takes place within affiliate segments of a group company in different tax jurisdictions.

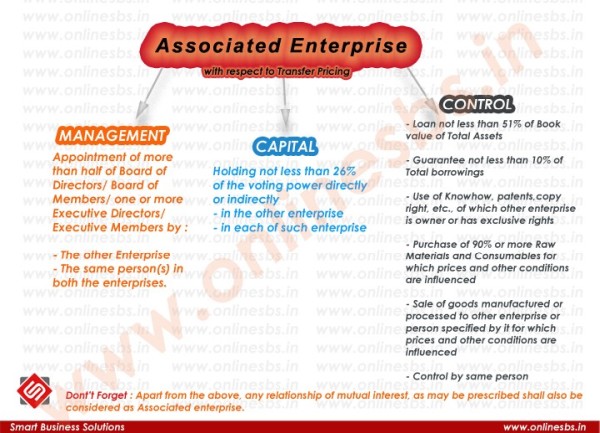

‘International transaction’ means any of the following nature of transactions between

two or more “Associated enterprise” where, either or both of whom are non-residents

In other words if both or all the enterprises executing the transaction are residents,

then it is not an “International Transaction” for the purpose of these provisions

c. lease of tangible or intangible property,

e. lending or borrowing money, or

f. any other transaction having a bearing on the profits, income, losses or

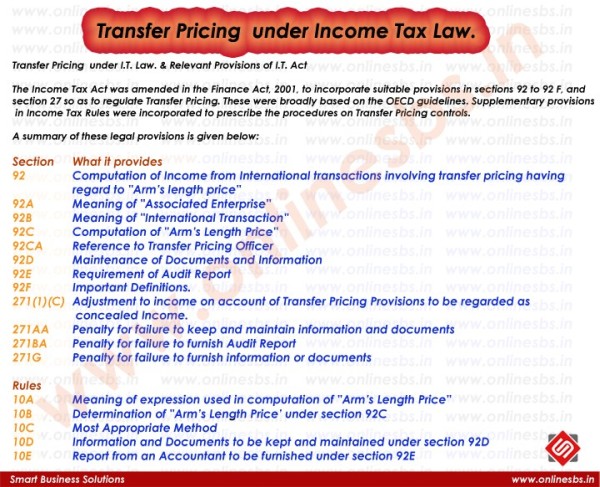

What is Transfer pricing as per Tax Perspective?

The use of this Transfer Pricing tax strategy attracted a huge level of international attention,

When is Transfer Pricing used?

Factors Effecting Transfer Pricing

2. Double Taxation Issue (see Diagram)

FOR COMPLETE INFORMATION CLICK HERE

CAclubindia

CAclubindia