While submitting Form 26QB, I made two mistakes

- I made a rounding error which caused a short deduction of Rs 0.47

- I entered incorrect Date of Payment in the challan which gave impression that I had filed the TDS late.

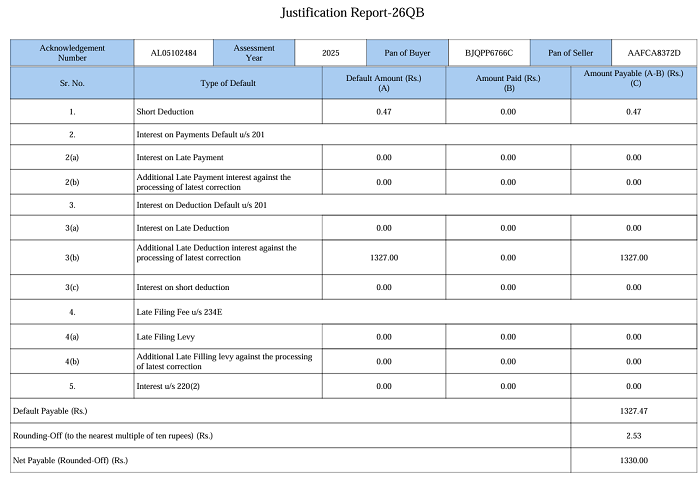

For this, I received a notice from TDS CPC which mentioned Short Deduction, Interest on Late Payment & Late Filing Levy.

Then I submitted a request for correction of Date of Payment in Form 26QB through TRACES portal. This request got approved after verification of all documents & transactions. Unfortunately, I did not do anything about Short Deduction.

After the correction got approved, I received another notice in which there is a demand Rs. 1,327 for Late Deduction interest against the processing of latest correction. Apparently this amount is 1% of Total Amount for which I had paid TDS.

Is paying the demand my only option now? Any guidance would be appreciated.

CAclubindia

CAclubindia