*

422 Points

Joined December 2017

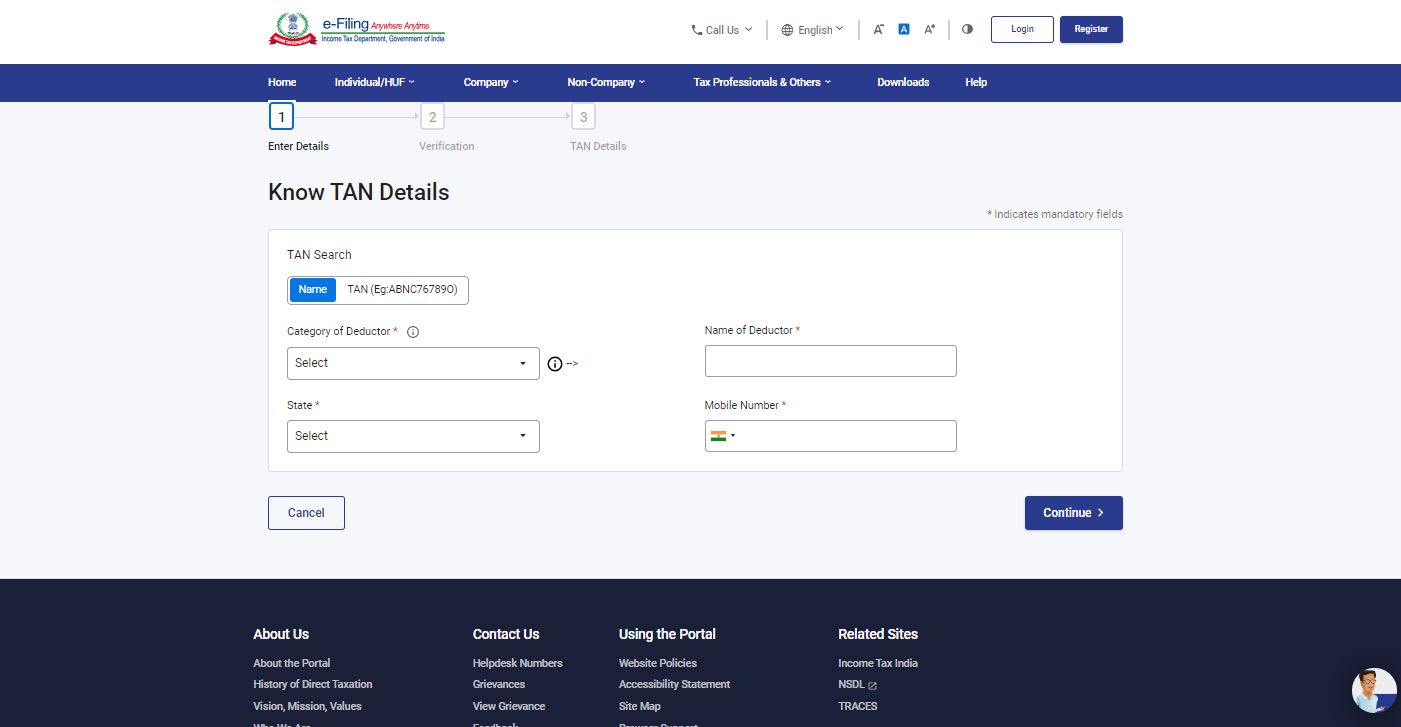

- Visit the official Income Tax e-Filing website.

- Look for the 'Know Your TAN' tab and click on it. This option helps you find information about a Tax Deduction and Collection Account Number (TAN).

- On the 'TAN Search' page, you will find two options: 'TAN' and 'Name'. Choose the option that suits your search criteria.

- Now, you will find the 'Category of Deductor' section. Select the appropriate category that applies to you or the deductor you are searching for.

- Next, select the 'State' from the provided options. Choose the state where the deductor is registered or where you are seeking information from.

- Based on the option you selected in (TAN or Name), enter the details in the ‘TAN of Deductor / Name of Deductor’ Search field.

- In the next field, enter your registered ‘mobile number’ and click on the 'Continue' button to proceed.

- You will receive an OTP (One-Time Password) on your registered mobile number. Enter the OTP in the designated field on the website.

- After entering the OTP, click on the 'Validate' option to validate the entered OTP.

- Once the OTP is validated successfully, the website will display the TAN-related details on the screen. These details may include the deductor's name, address, TAN number, and other relevant information.

Note : For TAN Allotment date you can check the TAN Allotment Letter.

CAclubindia

CAclubindia