CA

35 Points

Joined November 2009

|

Originally posted by : prateek |

|

guys the following question ws asked in NOVEMBER 2011 SFM paper........i wanna knw frm which chapter or concept it is related.........

|

|

Itz one of the study material question...

Solution:

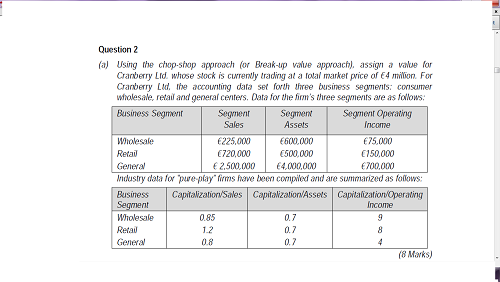

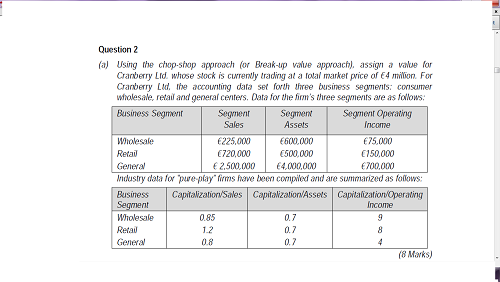

1. Valuation under various Bases

Particulars Wholesale Retail General Total

(a) Segment Sale Based Valuation 1,91,250 8,64,000 20,00,000 30,55,250

(Segment Sales × Capitalisation Rate) (2,25,000 × 0.85) (7,20,000 × 1.2) (25,00,000 × 0.8)

(b) Segment Asset Based Valuation 4,20,000 3,50,000 28,00,000 35,70,000

(Segment Assets × Capitalisation Rate) (6,00,000 × 0.7) (5,00,000 × 0.7) (40,00,000 × 0.7)

(c) Segment Operating Income Based Valuation 6,75,000 12,00,000 28,00,000 46,75,000

(Segment Income × Capitalisation Rate) (75,000 × 9) (1,50,000 × 8) (7,00,000 × 4)

2. Average Capitalisation Based on Book Values of Factors

= (€ 30,55,250 + € 35,70,000 + € 46,75,000) / 3 = € 37,66,750

3. Break Up Value

Break Up Value can be the average of Book Value and Market Value = (€ 37,66,750 + € 40,00,000) ÷ 2 = € 38,83,375