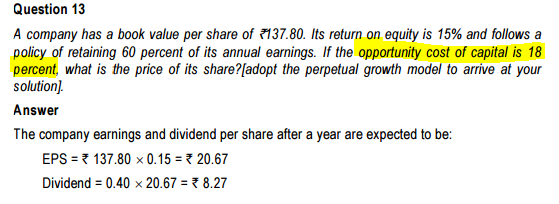

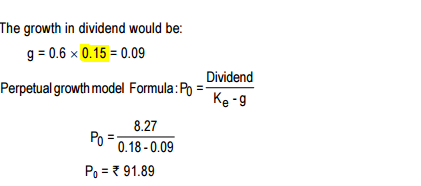

This is a question from practise manual. Please note the highlighted part,for growth rate calculation,as per me,opportunity cost should have been used,but here Ke is used. Where am I wrong?

This is a question from practise manual. Please note the highlighted part,for growth rate calculation,as per me,opportunity cost should have been used,but here Ke is used. Where am I wrong?