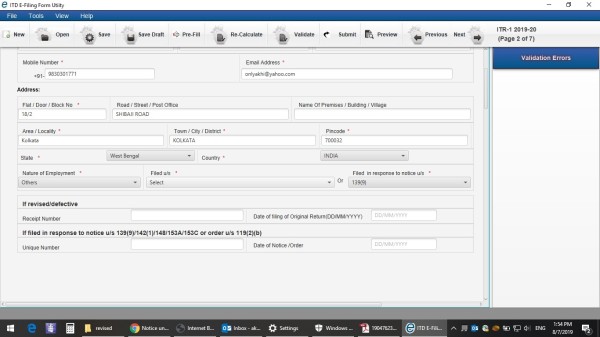

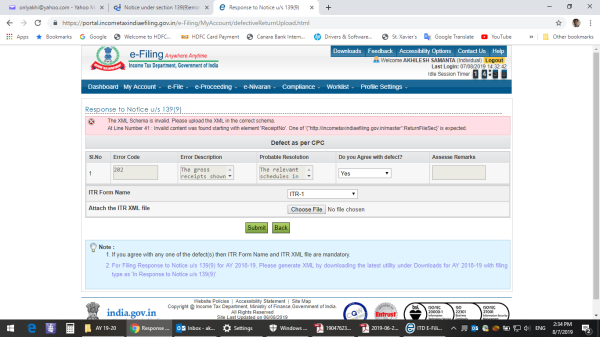

The gross receipts shown in Form 26AS, on which credit for TDS has been claimed, are higher than the total of the receipts shown under all heads of income, in the return of income. Thus, while credit for TDS is being claimed, the corresponding receipts are not offered in the respective income schedules, to arrive at the taxable total income Hence, the return of income filed is regarded as defective, as provided in Explanataion (a) under section 139(9) error code 202 how do i respond to this notice?

Read more at: https://www.caclubindia.com/forum/details.asp?mod_id=510309

Menu

Section 139(9) error code 202

Replies (14)

Recent Threads

- Documents for return exhibition material

- Can I set off equity losses(both short term loss a

- Input tax credit on rent to rent

- Family Pension Army

- Waste Management services

- Seeking Clarity: New Transport Allowance Limits (D

- Query regarding Consolidated Gift Deed for Bank Tr

- TDS u/s194IB - Joint Ownership

- Free GST Reconciliation Tool in Google Sheets R

- NRI return after due date refund case

Related Threads

CAclubindia

CAclubindia