Hello Everyone,

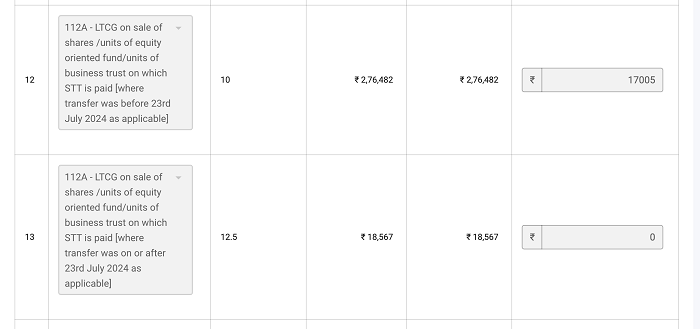

I am filling ITR2 and completed Schedule Capital Gain and Schedule 112A. The sum of capital gain before 23rd July and After 23rd July 2024 is correctly bifurcated and visible in Schedule SI but it seems something is wrong with tax calculation.

Why it has not calculation 12.5% tax applicable on the amount 18567 ? Is there something I am missing. Please suggest.

Thanks

CAclubindia

CAclubindia