Menu

salary detail problem

wht to do in this case, plz answer in serial wise.

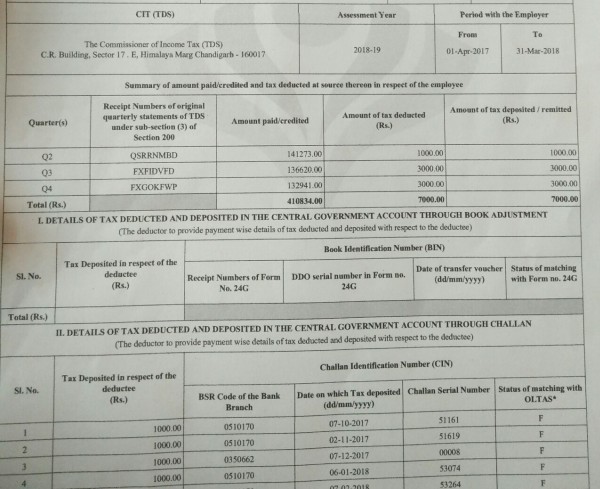

1) tds deducted by employer on salary in form 16 is higher as shown under 192 (26 AS)

2) commission received from employer is already included in form 16 in gross salary or not?

3) ESI, H.Ins, LWF is this also deductible under 80C ? ....bcz this amount is not mentioned in form 16 unser deduction.

1) tds deducted by employer on salary in form 16 is higher as shown under 192 (26 AS)

2) commission received from employer is already included in form 16 in gross salary or not?

3) ESI, H.Ins, LWF is this also deductible under 80C ? ....bcz this amount is not mentioned in form 16 unser deduction.

Replies (9)

Recent Threads

- Houston Sign Company For Custom Signs, Banners &am

- Refund due to change in GST Rate Tobacco Products

- Lease related query can we rent out lease ?

- Planning of Ceased a Business i.e Closure of Compa

- Property value in 26QB

- Form 26QB Multiple Buyer/Multiple seller

- Company Formation for clothing business

- TDS on purchase 194Q

- Compensation for urban land acquisition

- Understanding section 269st

Related Threads

CAclubindia

CAclubindia